SVB latest live blog: Regulators weigh bailout of all unsecured SVB depositors to avoid ‘banking panic’

As the countdown to the reopening of futures trading gets stronger by the second amid episodic observations of bank runs across the US, the news flow is starting to accelerate quickly, so this will be a post placeholder with updates until we have important news.

Update at 3pm ET: In a reversal of what Janet Yellen said just hours ago, WaPo reports that federal authorities are “seriously considering safeguarding all uninsured deposits at Silicon Valley Bank” – and by extension any other bank about to fail – and are weighing extraordinary intervention to prevent what they fear will be a panic in the US financial system. Translation: bailing out all depositors, not just those guaranteed by the FDIC (

Officials from the Treasury Department, the Federal Reserve and the Federal Deposit Insurance Corporation discussed the idea this weekend, the people said, with just hours to go until the opening of financial markets in Asia. White House officials have also looked into the idea, according to two separate people familiar with the discussions. The plan would be one of the possible political responses if the government cannot find a buyer for the failed bank.

While selling SVB to a healthy institution remains the preferred solution, as most bank failures are resolved this way and allow depositors to avoid losing money, there have been several reports that so far no major bank has stepped up, leaving the government or the Fed. as the only option.

As previously reported, the FDIC began an auction process for SVB on Saturday and expected to identify a winning bidder by Sunday afternoon, with final bids at 2 pm ET.

Some more from the WaPo report:

Although the FDIC insures bank deposits of up to $250,000, a provision of federal banking law can also give them the authority to protect uninsured deposits if they conclude that not doing so would pose a systemic risk to the broader financial system. wide, people said.. In this case, uninsured deposits could be backed by an insurance fund, regularly paid by US banks.

Before that happens, the systemic risk verdict must be approved by a two-thirds vote of the Fed’s Board of Governors and the FDIC board along with Treasury Secretary Janet Yellen. No final decision has been made, but the deliberations reflect concerns about collateral damage from the SVB’s collapse and the authorities’ struggle to respond amid limits on their powers implemented after the 2008 bailouts.

“We’ve been listening to these depositors and other concerned people this weekend. So let me say that I’ve been working all weekend with our bank regulators to design appropriate policies to address this situation,” Yellen said on the program from CBS’ “Face the Nation.”

But more importantly, the WaPo report contradicts what Yellen said just hours earlier, namely that “during the financial crisis, there were investors and owners of large systemic banks that were bailed out . . . and the reforms that have been put in place mean that we won’t do it again.”

This suggests that within hours, officials and regulators peaked behind the scenes and realized how bad a potentially bad crisis could be and have made an 1800-degree U-turn.

The result: whatever false higher-for-longer narrative peddled by some self-styled pundits has just exploded, and what’s about to be unleashed is another massive wave of liquidity, something bitcoin is clearly starting to anticipate.

***

Update at 1:15 PM ET: In a throwback to the legendary “Lehman Sunday,” when dozens of credit traders held an ad hoc CDS trading and novation session on the Sunday before the bank’s Chapter 11 filing to minimize the chaos and fallout of the upcoming bankruptcy, Bloomberg reports that the FDIC began an auction process Saturday afternoon for Silicon Valley Bank, with final bids due Sunday afternoon..

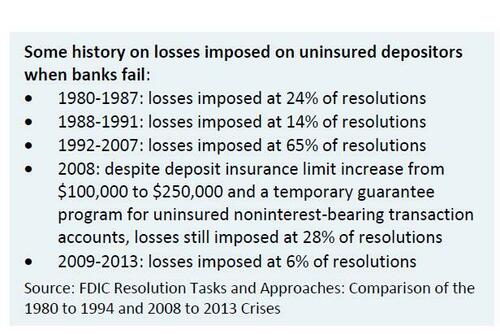

The FDIC is reportedly aiming for “a quick settlement,” but the winner may not be known until Sunday afternoon. Bloomberg also reported that the regulator is running to sell assets and make a portion of customers’ uninsured deposits available as early as Monday; the open questions are i) if there will be a haircut and ii) what size it will be. A table by JPM’s Michael Cemablest below shows historical cuts of uninsured depositors in previous banking crises.

We get a slightly more positive vibe from a Reuters report that “authorities are preparing “material action” on Sunday to shore up deposits at Silicon Valley Bank and stem any broader financial fallout from its sudden collapse.”

Details of the planned announcement Sunday were not immediately available. One source said the Federal Reserve had acted to keep banks open during the COVID-19 pandemic and could take similar steps now.

“This will be material action, not just words,” said one source. Earlier, US Treasury Secretary Janet Yellen said she was working with banking regulators to respond after SVB became the biggest bank to fail since the 2008 financial crisis.

As fears grew of a wider reach in the US regional banking sector and beyond, Yellen said she was working to protect depositors but ruled out a bailout.

“We want to make sure that the problems that are in one bank do not create contagion to others that are sound,” Yellen said on the CBS News Sunday Morning program. “During the financial crisis, there were investors and owners of large systemic banks that were bailed out … and the reforms that have been put in place mean that we won’t do that again,” Yellen added.

In the meantime, more than 3,500 CEOs and founders representing about 220,000 workers signed a petition started by Y Combinator appealing directly to Yellen and others to support depositors, warning that more than 100,000 jobs could be at risk.

Reuters also reports that the FDIC was trying to find another bank willing to merge with SVB:

“Some industry executives said such a deal would be significant for any bank and would likely require regulators to provide special guarantees and other allowances.”

That said, the longer we wait without a resolution, the more likely it is that SVB’s unsecured depositors will receive pennies on the dollar, according to the following (unconfirmed) report by Chalie Gasparino: “Bankers are increasingly pessimistic that a single buyer will emerge for SVB, set options for customers with money in there: 1. 2-sell deposits for about 70-80 cents on the dollar to other financial players – borrow against jpmorgan deposits at 50 cents on the dollar.

LATEST: Bankers increasingly pessimistic that a single buyer will emerge for SVB, proposing options for clients with money in there: 1. 2-sell deposits for about 70-80 cents on the dollar to other financial players; Borrow against @jpmorgan deposits at 50 cents on the dollar

— Charles Gasparino (@CGasparino) March 12, 2023

The FDIC previously said the agency said it will make 100 percent of protected deposits available Monday, when Silicon Valley Bank branches reopen.

There was also news for those whose money remains frozen at SIVB. BBG notes that the technology lender Liquidity Group plans to provide about $3 billion in emergency loans to emerging clients affected by the collapse of Silicon Valley Bank.

Liquidity has about $1.2 billion in cash ready to be made available in the coming weeks, CEO and co-founder Ron Daniel said in an interview on Sunday. The group is also in talks with its financing partners, such as Mitsubishi UFJ Financial Group Inc. of Japan and Apollo Global Management Inc., to provide an additional $2 billion in loans, he said.

“By helping businesses survive now, I hope some of them will succeed and come back to us in the future,” Daniel said. “We are nurturing our future customers.” A typical loan will be a one-year line of $1 million to $10 million, or up to 30 percent of SVB balances, Daniel said. The priority is to help companies deal with payroll costs.

The fate of other entities linked to SVB seems to be somewhat better. Bloomberg reports that Royal Group, an investment firm controlled by a major Abu Dhabi royal, is considering a possible takeover of Silicon Valley Bank’s UK arm following its collapse last week, according to people familiar with the matter. The conglomerate, chaired by UAE National Security Advisor Sheikh Tahnoon bin Zayed Al Nahyan, is discussing a possible purchase through one of its subsidiaries.