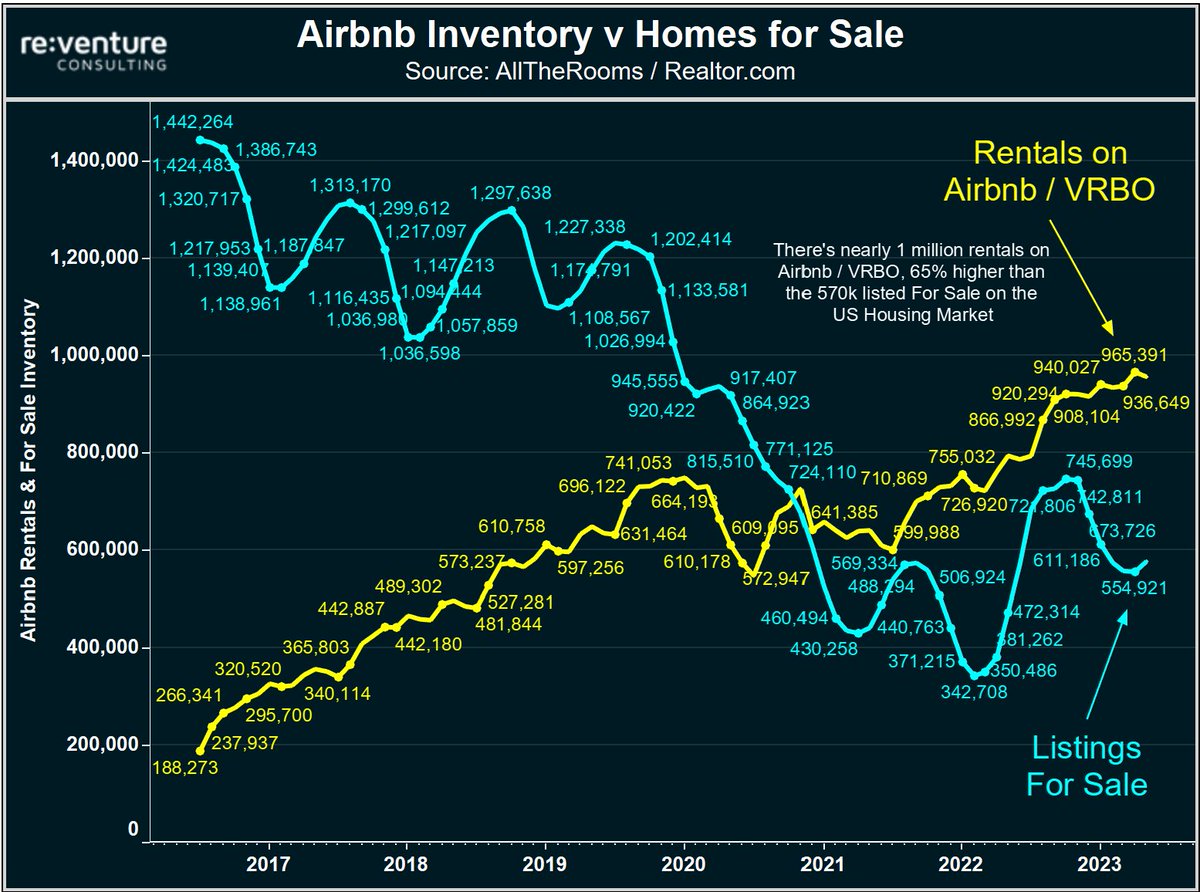

AllTheRooms data shows 1 million Airbnb/VRBO rentals.

Compared to just 570,000 homes for sale.

It creates a huge home price disadvantage if struggling Airbnb owners decide to sell.

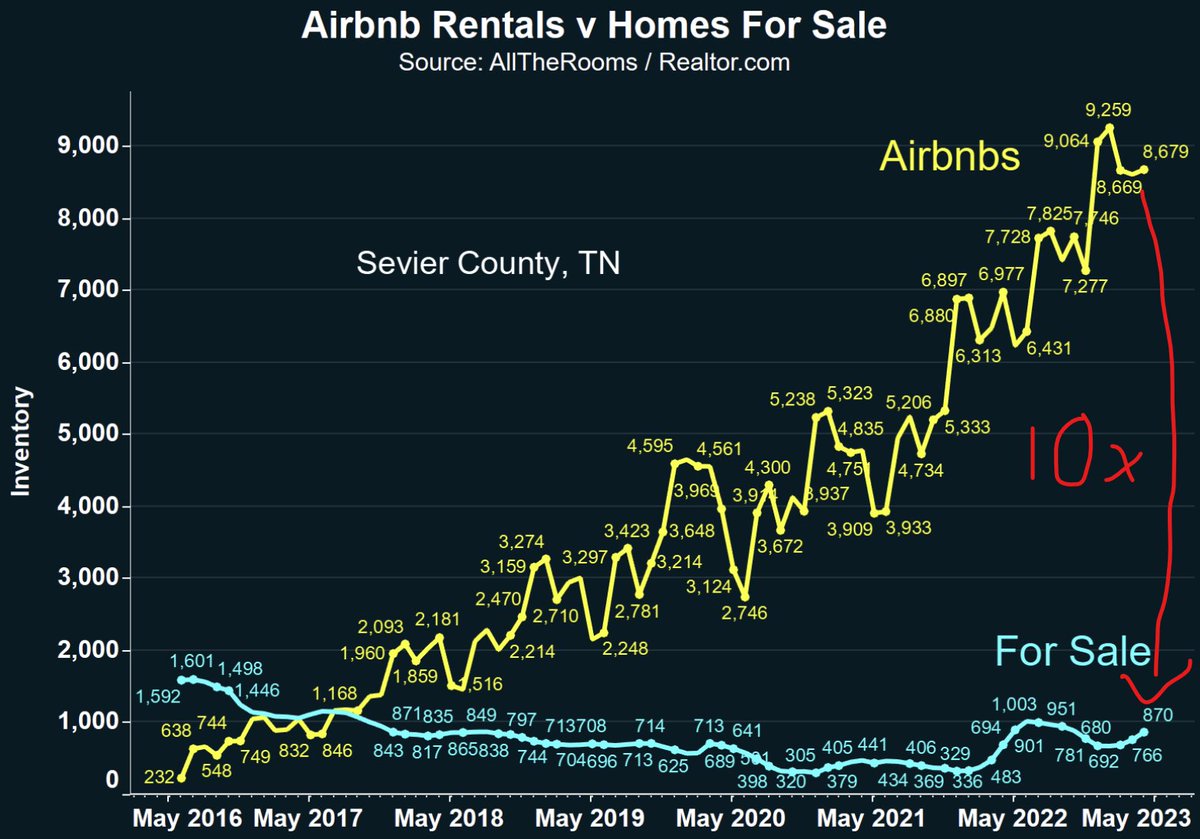

When the number of short-term rentals (18k) is more than DOUBLE the number of for-sale listings (8k).

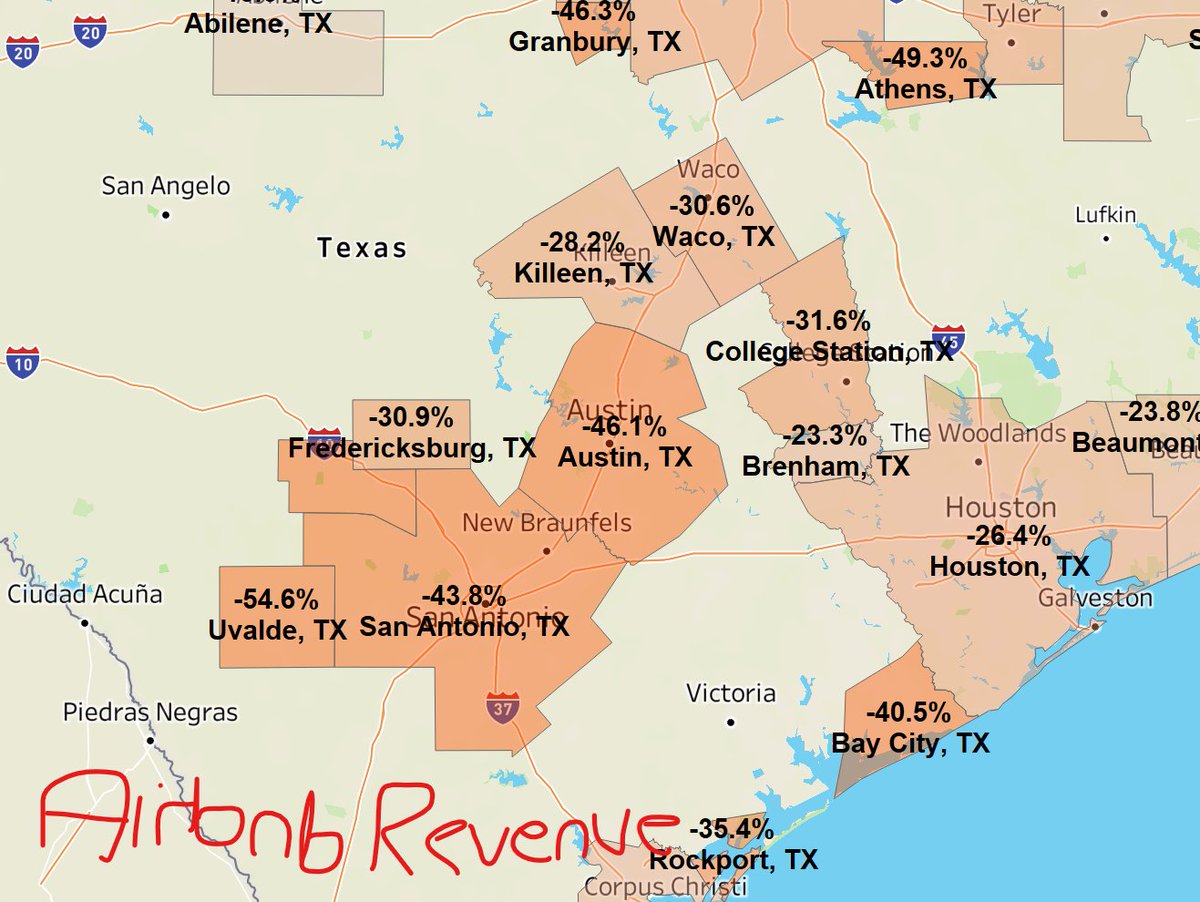

Mix in Airbnb’s huge offering with less than -50% income and you’ve got a cocktail for a massive sell-off.

Particularly a vacation town called Sevierville in the Smokey Mountains.

There are 10 times more Airbnbs than homes for sale in this county. While the income per owner is reduced by almost 50%.

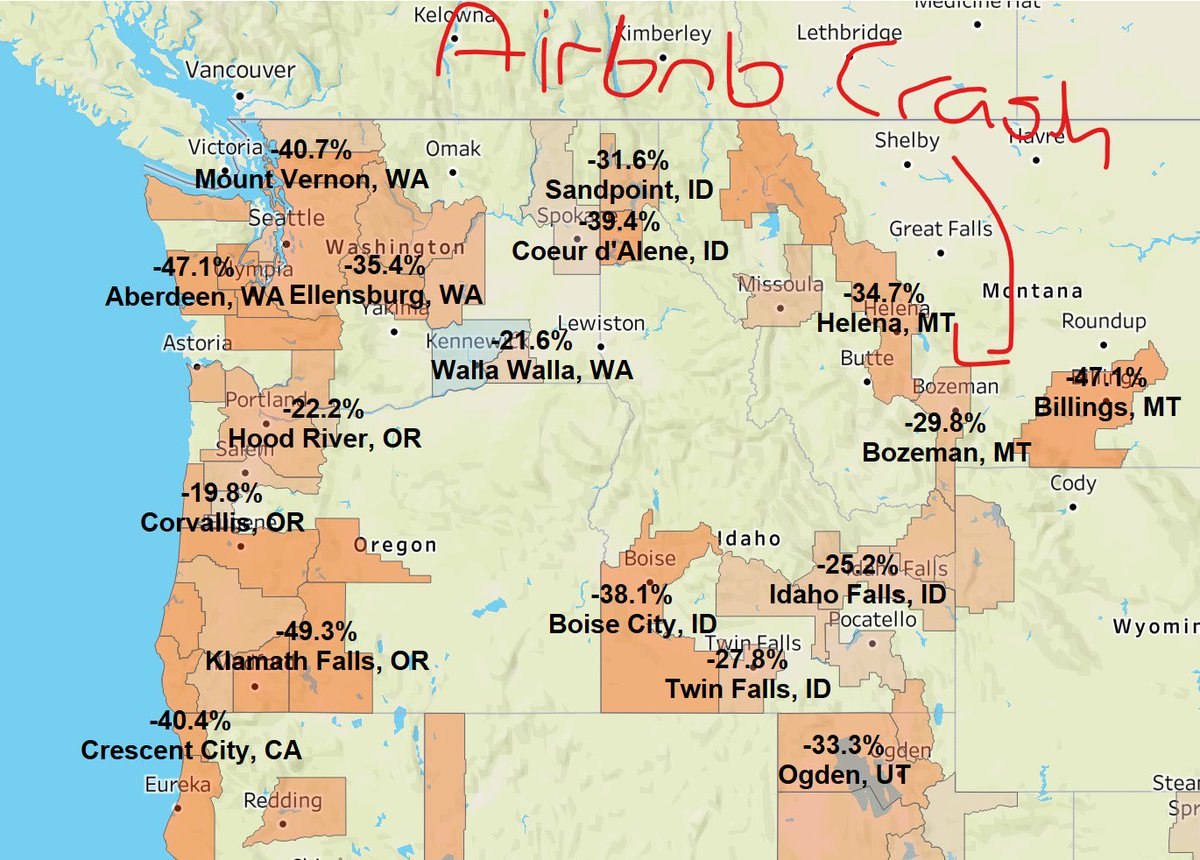

AllTheRooms data shows that Airbnb revenue is down 40-50% year-over-year in most of the area.

States like Montana, Idaho and Oregon.

Fewer people playing with their Yellowstone fantasies + much more supply = 40% decrease in income per listing.

The pandemic is over. Fewer people work from home or vacation in states like Montana, Texas and Tennessee.

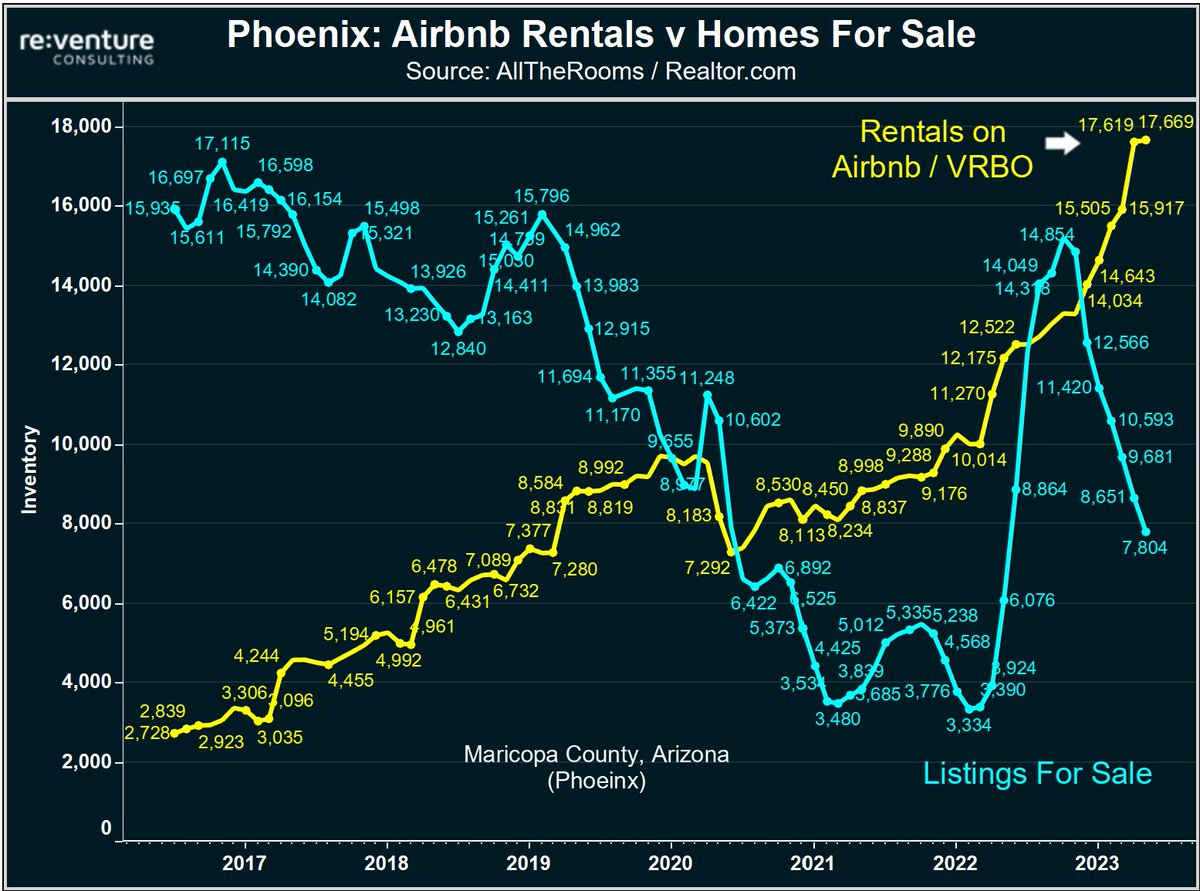

So the demand has dropped a lot. Just when the supply of Airbnb increased greatly. So you have a shock.

Many of them are seeing their income drop by 50%.

But the main narrative has yet to catch up. So landlords may not realize that Airbnb’s crash is a broader trend.

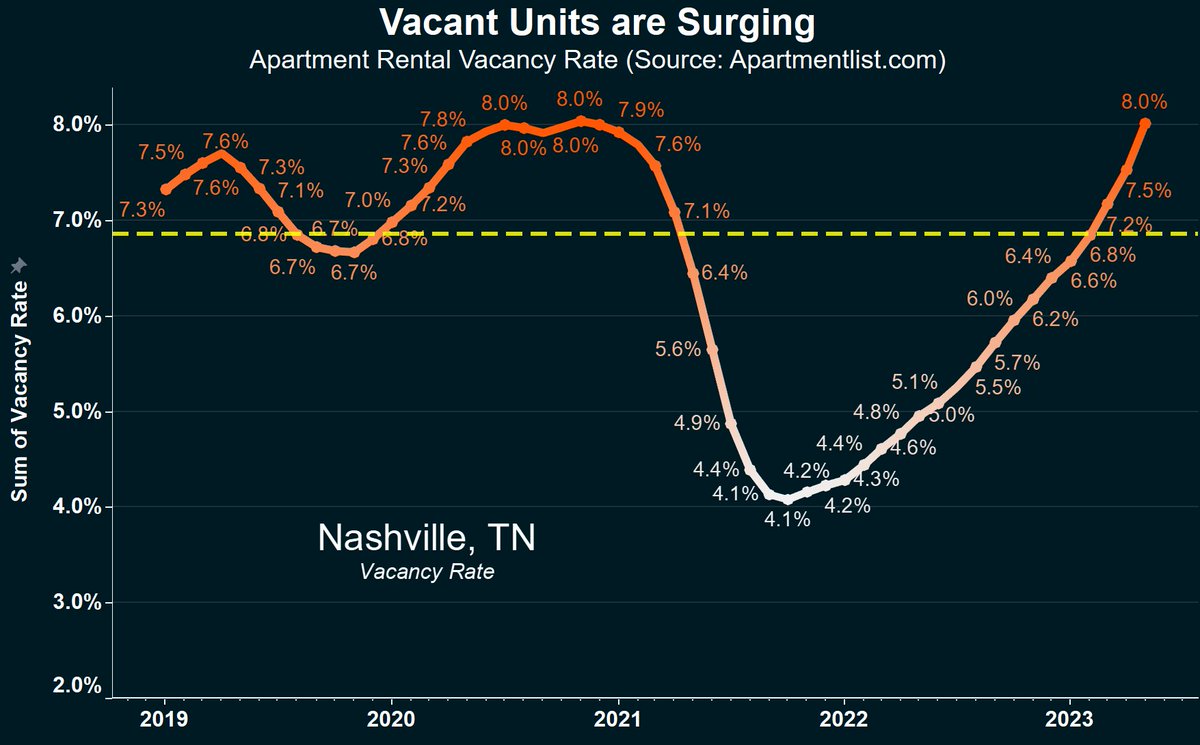

But the problem is that there has already been a huge increase in long-term rentals coming onto the market.

With rental vacancies exploding in cities like Nashville over the past year.

Especially in dense urban areas. That’s where most Airbnbs are located.

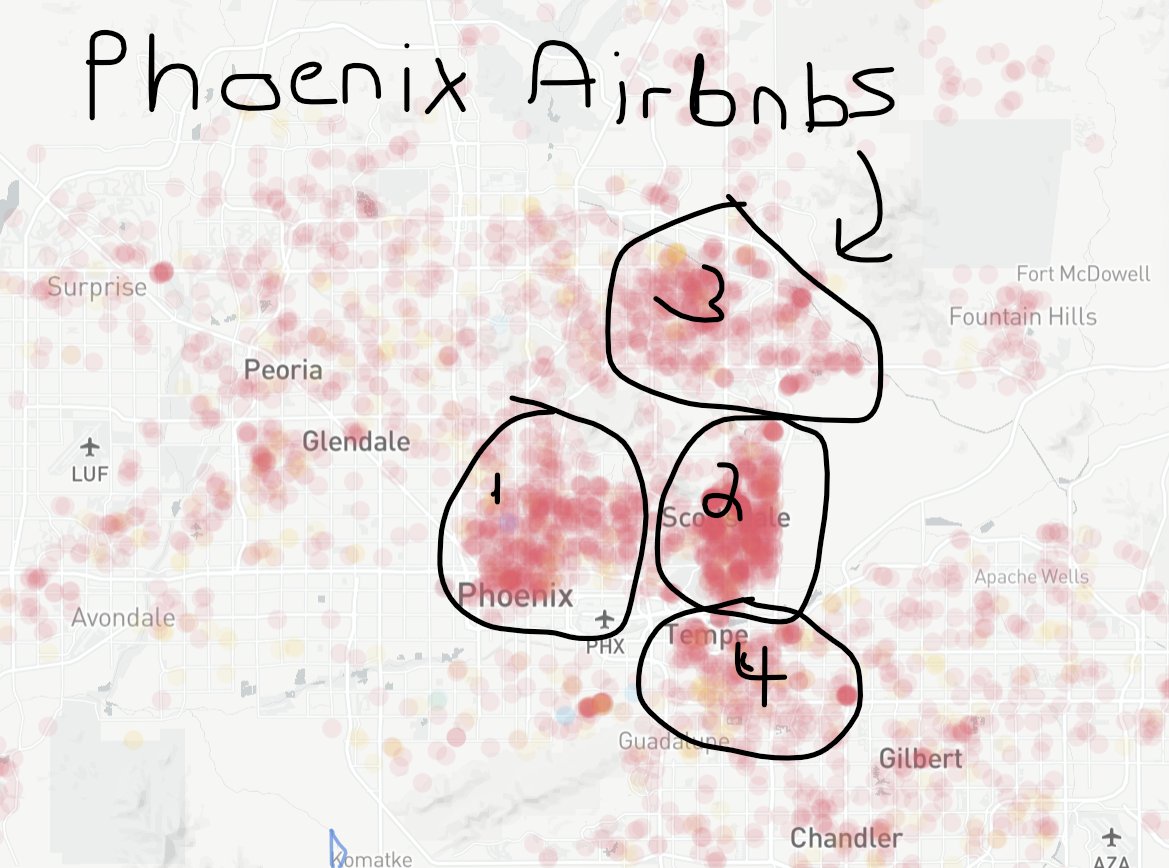

Check out Airbnb’s heat map in a metro like Phoenix to see the areas with the most exposure.

They came in at a high price. And have a high monthly payment. And little margin for error.

They could be among the first to sell later in 2023, when the season ends.

They paid less for their Airbnb. Get a cheaper mortgage. And more experience.

They will be less likely to sell.

The data used in this tweet comes from AllTheRooms. They are a short-term rental data provider that tracks Airbnb supply, rates, and revenue for every market in the country.

• • •

Missing a tweet in this thread? You can try

force an update