for Brian Shilhavy

Editor, Health Impact News

Credit Suisse, which was Switzerland’s second largest bank and considered a “too big to fail” bank, has failed.

Swiss authorities rushed to a deal late Sunday to try to prevent a large-scale stock market crash before it began trading in Asia, along with futures trading in the US.

The deal involved a forced sale to its rival bank, Switzerland’s largest bank, the Swiss National Bank (SNB), which included bailout money from the Swiss Central Bank for the SNB, along with a bailout of AT1 bonds with Credit Suisse used. to finance pensions for the elderly, which will be completely wiped out.

Finally we have a deal, and what was initially a 1 billion franc acquisition price of Credit Suisse by UBS, which later rose to 2 billion francs, has now been increased for the last time up to 3 billion francs (US$3.25 billion), or 0.76 per share, namely Credit Suisse shareholders will receive 1 UBS share for 22.48 Credit Suisse shares. As part of the deal, the Swiss National Bank is providing liquidity assistance of 100 billion francs to UBS while the government is providing a guarantee of 9 billion francs for potential asset losses that UBS is assuming, is in other words, it is a taxpayer-backed company. rescue

More importantly, however, the bank’s entire AT1 tranche (about 16 billion francs of Additional Tier 1 (AT1) bonds, a $275 billion market) will be bailed out and reduced to zero, meaning: “FINMA has determined that Credit Suisse’s additional Tier 1 capital (arising from the issuance of Tier 1 capital bonds) for a total nominal amount of approximately CHF 16 billion will be written off to zero.”

This write-off, forgiveness and rescue is the largest loss to date for Europe’s $275bn AT1 market, far eclipsing the roughly €1.35bn loss suffered by holders of the Spanish lender’s junior bonds Banco Popular SA in 2017, when it was absorbed by Banco Santander. SA to avoid a collapse.

AT1 bonds were introduced in Europe after the global financial crisis to act as buffers when banks start to fail. They are designed to impose permanent losses on bondholders or convert to equity if a bank’s capital ratios fall below a predetermined level, effectively bolstering its balance sheet and allowing it to stay in business.

As Bloomberg points out, investors had worried that the so-called bail-in would result in the cancellation of the AT1s, while the senior debt issued by the holding company, Credit Suisse, would become the bank’s capital.

In retrospect, they were right to be concerned… meanwhile, equity holders get 3 billion francs; We’re sure the Swiss pensions will be happy to receive a donut while the Saudis get a not-so-significant recovery. (Full article.)

The scrapping of the elderly pension bailout is sure to fuel protests already taking place across Europe over pension reforms, particularly in France, where protests began on Thursday night last week when President Emmanuel Macron invoked what is essentially an “executive order” before the French Parliament was ready. vote and DISAPPROVE the pension reforms.

The French have been demonstrating in the streets since then, continuing into Sunday night as live reports are still being broadcast showing much of France burning as I write this.

I did a short video report on the protests in France, which are now banned, but the French people don’t seem to care too much about the ban. This is on our Bitchute channel.

Could we see similar types of bailouts and pension funds disappear in the US?

This is what the CEO of the largest US investment firm said a few days ago:

BlackRock CEO Larry Fink Sees Retirement As ‘Silent Crisis’ Facing Global Economy

BlackRock CEO Larry Fink raised the specter of a “silent crisis” in retirement facing the global economy as rising longevity means issues such as rising costs of housing and health care for retirees are more daunting.

In his widely watched annual letter, Fink, the co-founder of the $8.6 trillion money manager, said that “investing for a financial goal like retirement is an act of hope and optimism, demonstrating a perspective long term, trust in financial institutions and belief in the integrity of the market”.

Fink pointed to lower market return expectations, higher housing and health care costs for retirees, and the shifting of retirement risks to individuals as factors making it harder to support longer longevity.

Fink said some of the issues driving the retirement crisis include populations in Europe, North America, China and Japan that are aging due to increased lifespans and falling birthrates. In the US, for example, 10,000 people turn 65 every day.

“This has profound implications for each of these markets over time. It will translate into a smaller labor force and cause incomes to grow more slowly or even decline,” Fink said. (Full article. Subscription required.)

Read between the lines what you will and draw your own conclusions about possible future US bailouts

Also, note that while depositors were bailed out in last week’s Silicon Valley Bank collapse, that mostly included wealthy individuals who had millions on deposit there, such as California Gov. Gavin Newsom and billionaire Mark Cuban, the shareholders were NOT bailed out. and risk losing everything since the bank has now declared bankruptcy and no buyer has yet stepped forward to bail out the bank.

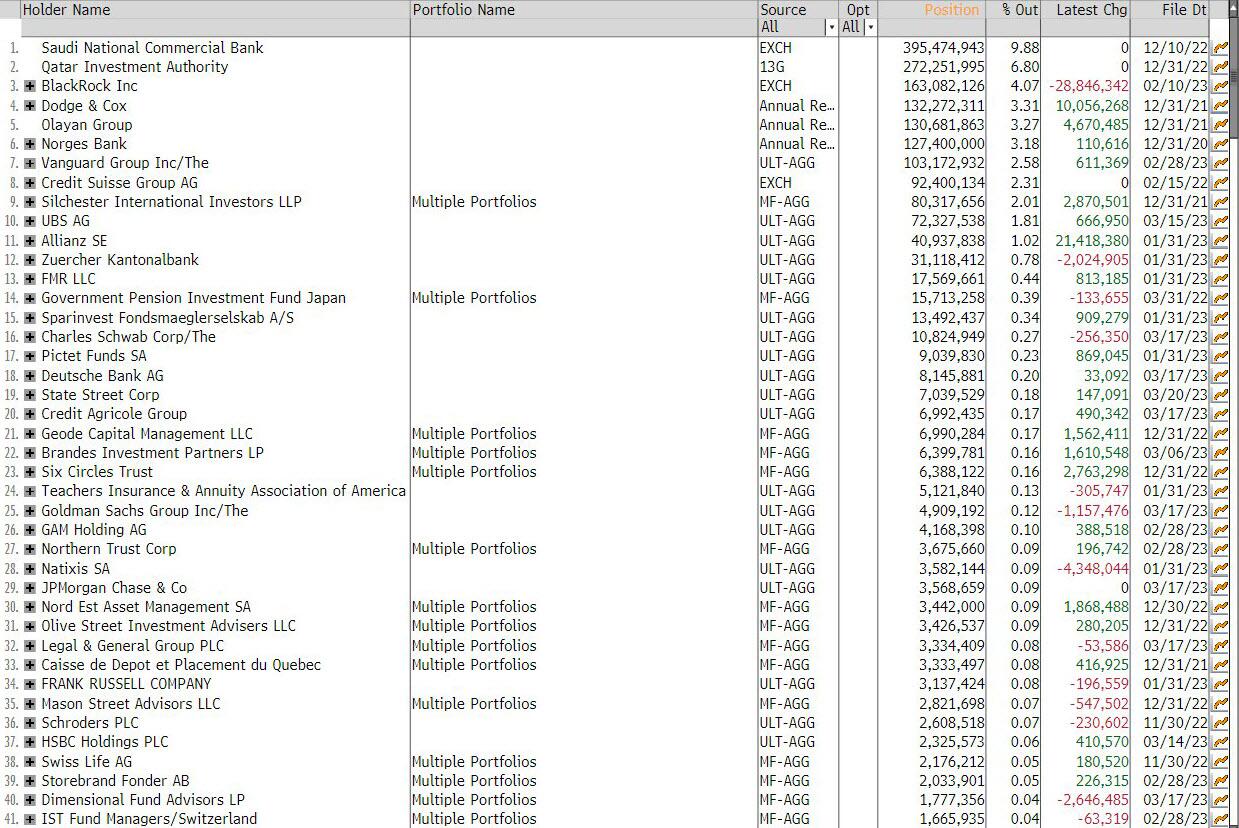

Silicon Valley Bank’s top three shareholders were reportedly: Vanguard Group (11.3%), BlackRock (8.1%) and StateStreet (5.2%), which are also among the top US companies that they have pension funds.

These companies, and many others in the United States and around the world, also had large sums invested in the now-failed Credit Suisse bank.

Related:

The government can stop issuing Social Security payments after the debt limit has been reached

Now everyone is looking to Warren Buffet for advice, including the Biden administration

Who owns the World Health Organization and its plan to vaccinate and digitally track every human being on the planet? (Article.)

It is being widely reported that Warren Buffet is now advising the Biden administration. In addition to the White House, more than 20 private jets reportedly landed in Omaha yesterday, including CEOs of regional banks, to seek Buffett’s advice.

What do you call it when an 80-year-old asks a 92-year-old for advice?

Answer: The worst financial crisis since Lehman.TM

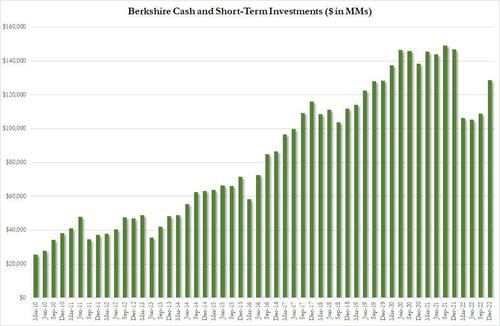

Realizing that Berkshire Hathaway had a near-record $128 billion in cash at the start of the year, more than most countries…

… Joe Biden, who on Monday lied to the American people that the “our banking system is safe“…

… appears to have changed his mind and is urgently hoping to recreate the zeitgeist surrounding Warren Buffett’s infamous Oct. 16 “Buy American” NYT op-ed.

… which ended up being memorable but only after the biggest bailout of US banks and capital markets in history and the start of the endless QR/ZIRP->bust->QE/ZIRP cycle.

According to Bloomberg, Berkshire’s Warren Buffett has been in contact with senior officials in President Joe Biden’s administration in recent days as the regional banking crisis goes from bad to worse in Savings And Loan 2.0 (If Only Savings Were Left to the United States).

The buzz of Omaha-centered private jet activity was first reported by Fuzzy Panda, who noted that “a large number (>20) of private jets landed in Omaha yesterday afternoon” with jets flying from regional bank headquarters, ski resorts and DC, ii asked the question “Buffett just brought all the CEOs of the regional banks to Omaha and offered a deal to SAVE the banks?”

The Private Jets arrived in Omaha in several groups. Sometimes landing almost at the exact same time.

Did Buffett schedule some meetings with different groups of CEOs every hour?

Number of Jets arriving:

5~10am (Eastern)

3 ~ 2 p. m

5 ~ 3:30 p.m

5 ~ 5 p. m

6 ~ 6:15 p.m. m

3 ~ 19:30 pic.twitter.com/68Ok6zl8cA

— FuzzyPanda 🇺🇦 (@FuzzyPandaShort) March 17, 2023

Read the full article at ZeroHedge News.

Get ready for another wild week as the banking crisis goes from bad to worse.

The corporate media and most alternative media are distracted by political news, such as the alleged arrest of Donald Trump this week, which compared to the banking crisis and the escalation of World War III centered on Ukraine, is quite insignificant.

See also:

Understand the times we are currently living in

Year 2023: Will America Fulfill Its Destiny? Jesus Christ is the only “transhuman” the world has seen or will ever see

An invitation to technologists to join the winning side

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

Spiritual wisdom vs. natural knowledge: why there is so much deception today

How to determine if you are a disciple of Jesus Christ or not

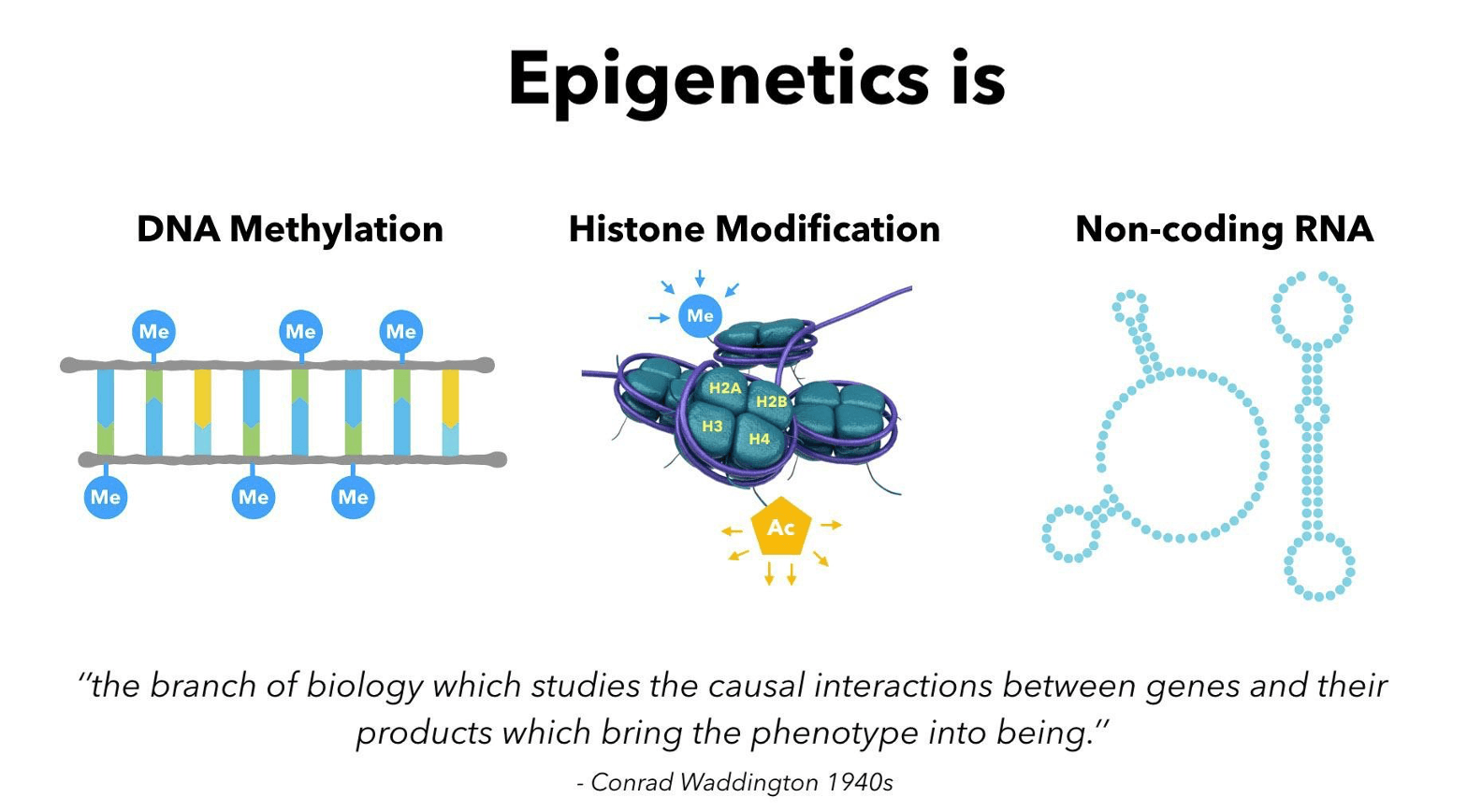

Epigenetics exposes Darwinian biology as religion: Your DNA does NOT determine your health!

What happens when a holy and just God gets angry? Lessons from history and the prophet Jeremiah

Insider exposes Freemasonry as the world’s oldest secret religion and Luciferian plans for the new world order

Identifying the Luciferian Globalists Implementing the New World Order: Who Are the “Jews”?

Posted on March 19, 2023