It was clear from the start that Monday would be chaos for the markets – and as it turned out, it proved much more than that, with two-year Treasury yields collapsing the most in decades.

At stake was not only the integrity of the financial system, but also the availability of liquidity.

Bloomberg multi-asset strategist Ven Ram notes that since the start of the European morning, markets seem much calmer, with Treasury yields barely budging, the dollar trying to claw back a bit and stock futures much less jittery.

Briefly, we get February’s inflation reading, with average estimates for the year-on-year and monthly figures expected to show a slowdown.

There are two ways this could play out from the Fed’s perspective.

Scenario I:

Turmoil in markets continues, centered on concerns about the strength of other US regional banksliquidity drops, as it always does when the markets need it most!

In this scenario, what happens to February’s inflation prints becomes a sideshow.

In other words, even a surprise, higher-than-expected print won’t bother the Fed much.

After all, inflation is a pre-existing problem, and the Fed has time to fight it

Scenario 2:

If market jitters subside, inflation numbers, along with last week’s payrolls data and upcoming retail sales data, will regain their dominance.

Even so, the possibility of the Fed raising rates by 50 basis points is virtually nil.

Calming the markets in the face of the prospect of a systemic crisis stands head and shoulders above the fight against inflation from the perspective of the Fed.

After all, when a chronically ill patient meets with an accident, you first treat the patient for life-threatening injuries.

Long-term illness is not the priority of the hour, as every good doctor knows.

Also, as Bloomberg’s Sebastian Boyd points out, Today’s CPI print will come in a different world from what Jerome Powell described to Congress a week ago.

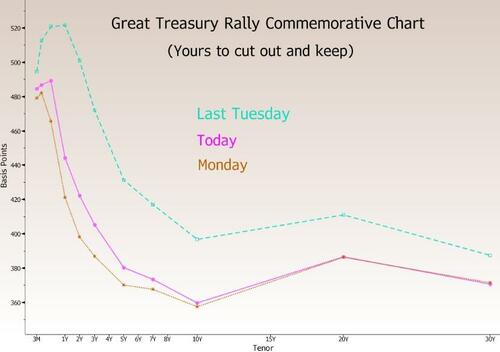

Just look at the massive revaluation of the Treasury curve since last Tuesday.

A chart like this is so unusual that you should print it out to show your grandkids.

Even if the CPI comes in hot, it’s hard to imagine the curve bouncing back, even if that might have been the Fed’s intention with its surprise announcement over the weekend.

That doesn’t mean returns won’t increase.

After Monday’s extreme price action, the most normal thing would be to see rates move higher.

Short-term Eurodollar yields, which were down 80bps at one point on Monday, have risen as much as 33bps on the day.

We may be on our way back to a terminal price close to 5%, but confidence has been shaken.

If the Fed’s plan was to tighten until something breaks, it looks like we’ve succeeded.

Last week is another country, they do things differently there.