for Brian Shilhavy

Editor, Health Impact News

On Sunday morning, US Treasury Secretary Janet Yellen appeared on the Sunday talk shows to announce that the Fed was NOT bailing out Silicon Valley Bank or any other bank, as it did in 2008.

However, faced with the possibility of bank runs and a Black Monday stock market collapse, the feds apparently reversed course (or maybe that was their intention all along?) and did just that which they said they wouldn’t do, and set off. Put in place a program to bail out depositors who were not covered by the FDIC’s $250,000 limit per account.

The FDIC also closed another bank, Signature Bank in New York, but assured depositors that they could get all their money out of their accounts on Monday.

And it worked, as futures trading that began Sunday night jumped, rather than crashed, and Wall Street breathed a sigh of relief.

Now we’ve had 3 FDIC insured banks fail in 5 days, but it doesn’t matter if your account was insured or not, the Fed will just give everyone the money back.

So the financial Armageddon has been postponed, again. Big Tech billionaires like Mark Cuban whined and whined over the weekend that the Fed wasn’t stepping in to save them, so the Fed obliged.

The banking system has been saved, for now, so billions of dollars can continue to pour into Wall Street to finance the military industrial complex to continue its wars, as well as billions of dollars flowing into Big Pharma to continue funding endless emergency use authorizations. for new drugs and vaccines.

This won’t solve the systemic problem in our financial system, but at least depositors should be able to access their money on Monday, even though that money will be worth far less than it was on Friday.

Get ready for massive consolidation of the banking industry now and the launch of digital IDs and eventually Central Bank Digital Currencies (CBDCs).

Fed Pics: Bank of signatures closed by regulators; The Fed, the TSY and the FDIC announce another bailout of the banking system

by ZeroHedge News

Panic is finally here.

We said on Friday that the Fed would make an announcement before Monday’s open, and we didn’t have to wait that long: in fact, the Fed waited just 15 minutes after the open for futures trading to announce the new bailout, along with even more shocking news: The Treasury announced that New York state regulators are shutting down Signature Bank, a major New York bank, adding that all depositors at Signature Bank, and also from the now insolvent Silicon Valley Bank, will have access to their money on Monday.

And while we process the shock of yet another small bank failure (making JPMorgan even bigger), the Fed just issued a statement saying that “To support American businesses and households, the Federal Reserve Board announced Sunday that it will make additional funds available to eligible depository institutions to help ensure that banks have the ability to meet the needs of all its depositors. This action will strengthen the banking system’s ability to safeguard deposits and ensure the continued supply of money and credit to the economy.“

The Fed also said it is ready to deal with any liquidity pressures that may arise, which in turn has just unveiled the first acronym for the new crisis bailout: the Bank Term Financing Program, or BTFP. Some more details:

The funding will be available through the creation of a new Bank Term Financing Program (BTFP), which provides loans of up to one year to banks, savings associations, credit unions and other eligible depository institutions that pledge bonds of US Treasuries, agency debt and mortgage-backed securities and other assets qualifying as collateral. These goods will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating the need for an institution to quickly sell such securities in times of stress.

The Fed explains that the Treasury Department will make available “Up to $25 billion from the Exchange Stabilization Fund to support the BTFP.” And while the Federal Reserve, which until Thursday had no idea about this banking crisis, does not anticipate that it will be necessary to draw on these backstop funds, we anticipate that the final number of backstop liquidity needed will be somewhere in the around 2 trillion dollars.

More from the Fed statement:

After receiving a recommendation from the boards of directors of the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve, Treasury Secretary Yellen, after consulting with the President, approved actions to allow the FDIC to complete its resolution of the Silicon Valley Bank in a way that protects all depositors, both insured and uninsured. These actions will reduce stress across the financial system, support financial stability and minimize any impact on businesses, households, taxpayers and the wider economy.

The Council is closely monitoring developments in the financial markets. The capital and liquidity positions of the US banking system are strong and the US financial system is resilient.

Depository institutions can obtain liquidity against a wide range of collateral through the discount window, which remains open and available. In addition, the discount window will apply the same margins used for BTFP-eligible securities, further increasing the loanable value in the window.

The Council is closely monitoring conditions in the financial system and stands ready to use its full range of tools to support households and businesses, and will take further action where appropriate.

But wait, there’s more: Concurrent with the Fed’s statement, the Treasury also issued a joint statement with the Fed and the FDIC in which Powell, Yellen and Gruenberg said they are “taking decisive action to protect the US economy by strengthening public confidence in our banking system. This step will ensure that America’s banking system continues to perform its vital functions of protecting deposits and providing access to credit to households and businesses in a way that promotes strong and sustainable economic growth.”

Also, the trio announced it all depositors at Silicon Valley Bank will be bailed out, as will depositors at Signature Bank in New York, which also just failed, and whose depositors will be penalized after invoking a “systemic risk exception.”

After receiving a recommendation from the Boards of Directors of the FDIC and the Federal Reserve, and consulting with the Chairman, Secretary Yellen approved actions that allow the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a way that fully protects all depositors. . Depositors will have access to all their money from Monday 13 March. The taxpayer will not bear any loss associated with the resolution of Silicon Valley Bank.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will remain intact. As with the Silicon Valley Bank resolution, there will be no loss to the taxpayer.

While depositors are safe, creditors and equity holders are not:

Shareholders and certain holders of unsecured debt will not be protected. Senior management has also been dismissed. Any loss from the Deposit Insurance Fund to support uninsured depositors will be recovered through a special assessment on banks as required by law.

Finally, the Federal Reserve Board announced on Sunday that it will make additional funds available to eligible depository institutions to help ensure that banks have the ability to meet the needs of all their depositors.

The conclusion:

The US banking system remains resilient and on solid footing, in large part due to reforms that took place after the financial crisis that ensured better safeguards for the banking sector. These reforms combined with current actions demonstrate our commitment to taking the necessary steps to ensure that depositors’ savings remain safe.

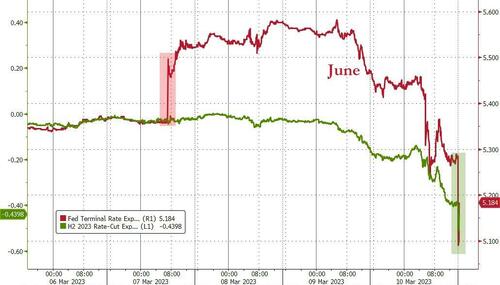

Translation: The Fed’s hiking cycle is dead and buried, and here comes the next round of massive liquidity injections. It also means that the Fed, Treasury, and FDIC just experienced the most devastating humiliation in recent history: just 4 days ago, Powell was telling Congress that he might raise 50 bp. and here we are now using taxpayer funds to bail out banks that have collapsed because they couldn’t even handle 4.75% and somehow the Fed has no idea!

To summarize:

Signature Bank has closed All Silicon Valley Bank and Signature Bank depositors will be fully protected. Shareholders and certain holders of unsecured debt will not be protected. New Fed 13(3) facility announced with $25 billion of ESF to protect bank deposits

As we previously said on Twitter, “This is a regulatory failure of historic proportions by both the Fed and the Treasury. Instead of avoiding billions in losses, the Fed was concerned about board diversity and Yellen was flying in Ukraine. Everyone should be fired immediately.”

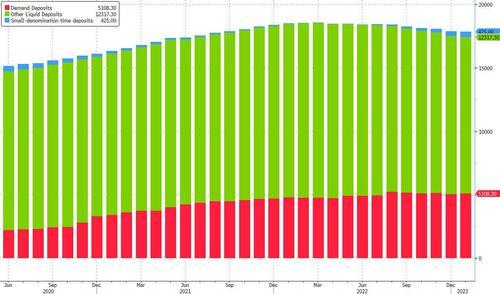

Oh, and if the Fed really thinks that $25 billion from the ESF will be enough to support a bank with $18 trillion in deposits…

… we wish them the best of luck.

Read the full article at ZeroHedge News.

See also:

Understand the times we are currently living in

Year 2023: Will America Fulfill Its Destiny? Jesus Christ is the only “transhuman” the world has seen or will ever see

An invitation to technologists to join the winning side

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

Spiritual wisdom vs. natural knowledge: why there is so much deception today

How to determine if you are a disciple of Jesus Christ or not

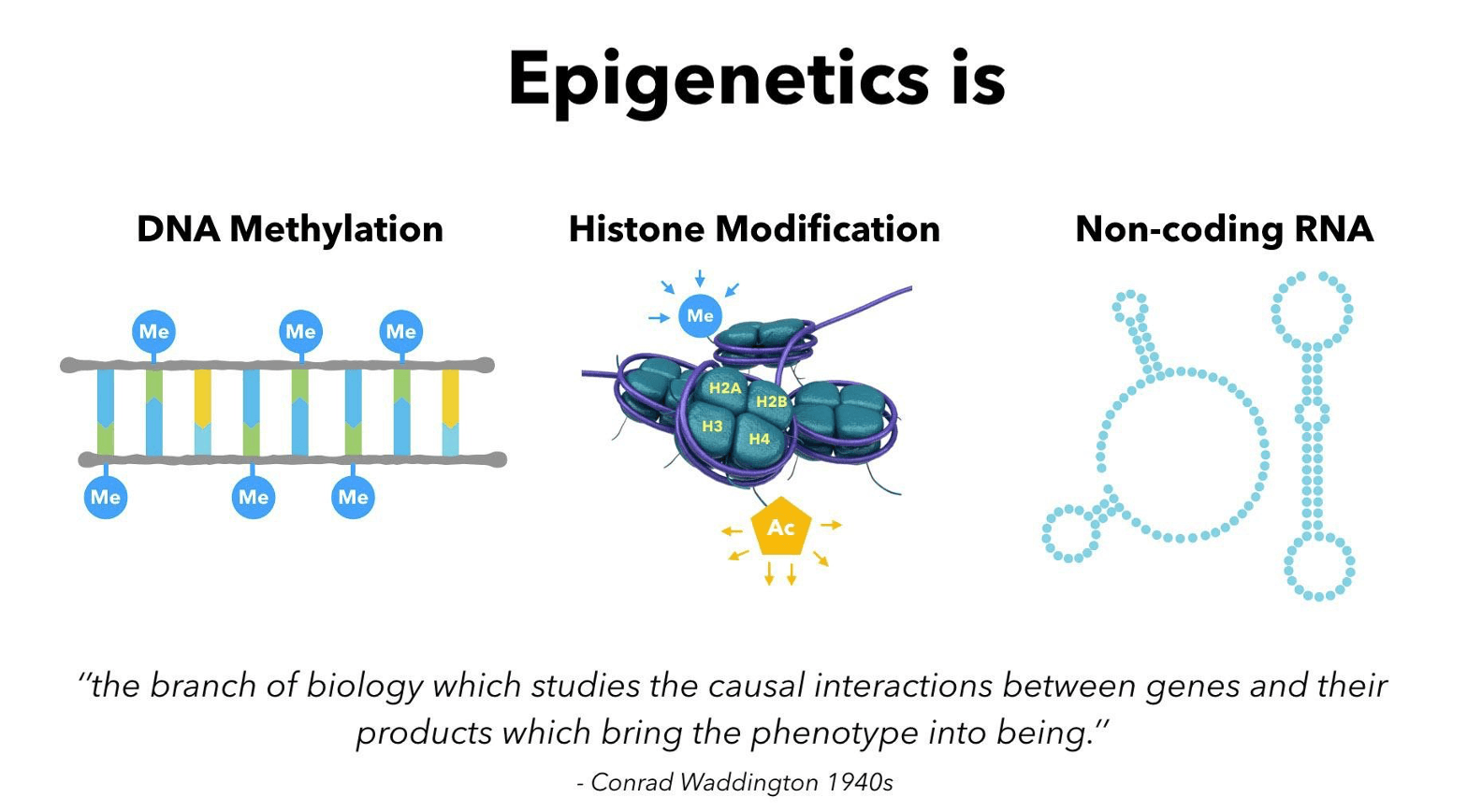

Epigenetics exposes Darwinian biology as religion: Your DNA does NOT determine your health!

What happens when a holy and just God gets angry? Lessons from history and the prophet Jeremiah

Insider exposes Freemasonry as the world’s oldest secret religion and Luciferian plans for the new world order

Identifying the Luciferian Globalists Implementing the New World Order: Who Are the “Jews”?

Posted on March 12, 2023