Written by Jesse Felder via TheFelderReport.com,

After the painful fall in stock prices last year, many investors have clearly come to the conclusion that this now represents another fantastic buying opportunity.

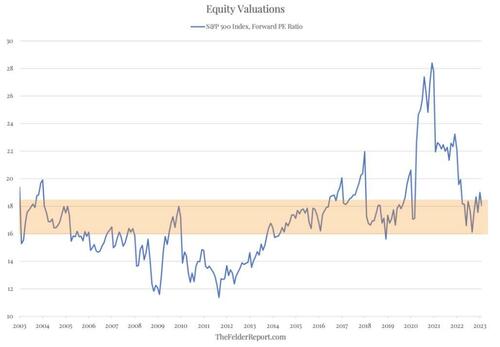

And if you only look at valuation measures based on earnings, you could be forgiven for thinking that while they may not be excessively cheap, equity valuations are no longer extreme. The forward price-to-earnings ratio now shows the S&P 500 trading at a multiple of about 17, very close to its average over the past two decades.

What this measure hides, however, is the fact that the profit margins supporting these gains are still obscene. Moreover, estimates assume that the recent decline in margins will soon reverse and return to near all-time highs. Certainly, there are at least some reasons (such as the strength of the dollar, interest rates and oil prices over the past two years) to be skeptical of this optimistic analysis. Rapidly rising labor costs tend to lead to steeper margin declines than we’ve already seen, and labor costs have already risen faster than at any point in the last thirty years.

If profit margins continue to decline throughout this year, instead of reversing as expected, the denominator of these forward price-to-earnings ratios could decline dramatically, revealing the fact that equity valuations were never really that reasonable in the first place. They only appear that way today as a result of some particularly heroic assumptions on the part of equity analysts.