Front-running the Fed’s pivot might not work next time

for Charles Hugh Smith

Of Two Minds

The Fed has trained the trade rats too well, and there is no way to avoid the unintended consequences of the Fed’s large-scale experiment in human behavior.

The Federal Reserve has been conducting a large-scale human behavior experiment since 2008. The results are in. Let’s start by stipulating that trading bots are programmed to trade on streams of human behavior, i.e. trends and reactions to policy announcements and other “news”. ” (earnings beat. etc.). As a result, the robot trading rats are responding to the same stimuli as the human trading rats in the Fed experiment.

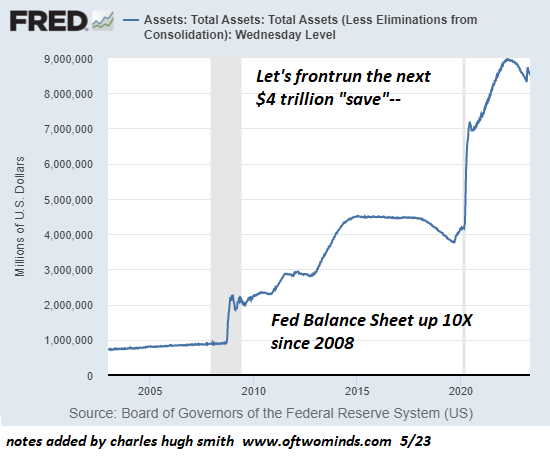

Here is the experiment setup. When the trade rats hit the red button, the stock market swoons and the Fed steps in to “save the market” by injecting trillions of dollars in stimulus and liquidity through various programs such as buying Treasuries. Trading rats who “buy the dip” are rewarded with big gains as the market rises once the Fed “pivots” from “hawkish” to “dovish.”

The trading rats are smart and so they realized they didn’t have to wait for the Fed to act to make big gains. Since everyone who plays the trading game knows that the Fed will turn in favor once the market swoons, then the trading rats began leading the Fed pivot, buying each swoon based on their supreme confidence that the Fed would soon “save the market” from the crash. .

The Fed is now trapped by the success of its large-scale behavioral experiment. The trading rats have such total confidence in the Fed Put, meaning the Fed “saves the market” once it passes out, because every time they’ve pushed the red button, the Fed has swung into action and unleashed a tsunami of stimulus and liquidity that reversed the swoon and pushed risk assets to new highs.

As a result of this feedback, the market never faints enough to trigger a Fed reaction because every dip is bought by leading trade rats. This can be seen as a success as the Fed no longer has to do anything to keep the market high as the leading trading rats come into action to buy every dip. The expectation of Fed “savings” is enough to keep the market in a comfortably high trading range.

The problem is that traders’ confidence in the Fed’s put encourages an almost infinite expansion of moral hazard, since traders can expand debt and leverage without limit because the consequences (potentially devastating losses) are ‘have removed from the table. the Fed’s “guaranteed” reversal of any swoon in risk assets.

Every trade rat focuses on his own debt and leverage, but there is no incentive to measure the systemic risk accumulated by the moral hazard generated by the Fed. Thus, the “guaranteed” reversal of any Fed swoon has created a perverse incentive to take on insane levels of risk to increase earnings, an increase in risk that now threatens the stability of the entire financial system.

No one believes a crash is possible because the Fed will reverse the swoon when the trade rats hit the red button. But the Fed is not omnipotent, and confidence in its omnipotence has turned into arrogance.

The only way the Fed can break this incentive to increase risky bets is to deliver a shock when the trade rats hit the red button. Instead of guaranteed gains, trading rats receive massive shock losses. To retrain the shop rats into their behavior, the Fed will have to deliver repeated shocks because the shop rats have been trained to expect treats from the Fed every time he presses the red button.

The first time they get a shock instead of a treat, the commercial rats will be confused, but will continue and press the red button again. They will keep pressing the red button and be surprised until they realize that the rules of the experiment have changed.

If the Fed randomly delivers treats and shocks, the trading rats will go into a catatonic-schizoid state of nervous breakdown. The trading rats will no longer know what to do and therefore will not buy every dip to lead the Fed, and will no longer be confident that the Fed will reverse the subsequent decline.

On the part of the Fed, if they continue to reward trade rats for accumulating risk, then the system will become increasingly vulnerable to a cascading collapse due to the insane levels of risk that have been incentivized by the Fed’s “guarantee” Fed.

If they fail to reverse each swoon, the market is vulnerable to a cascading fall as the trading rats are no longer confident that the Fed will bail out their incredibly risky bets.

Either way, fainting turns into uncontrollable shock. The Fed has trained the trade rats too well, and there is no way to avoid the unintended consequences of the Fed’s large-scale experiment in human behavior.

Perhaps the Fed can ask ChatAI to solve the intractable dilemma, but that will reveal the limits not only of Fed policy, but of ChatAI as well.

Read the full article at Of Two Minds.

See also:

Understand the times we are currently living in

Who are the children of Abraham?

The Brain Myth: Your intellect and thoughts originate in your heart, not your brain

God will not be fooled: a person reaps what he sows

An invitation to technologists to join the winning side

The God of All Comfort

Fact Check: “Christianity” and the Christian religion are NOT found in the Bible – the person Jesus Christ is

How to determine if you are a disciple of Jesus Christ or not

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

What happens when a holy and just God gets angry? Lessons from history and the prophet Jeremiah

Insider exposes Freemasonry as the world’s oldest secret religion and Luciferian plans for the new world order

Posted on May 23, 2023