Comments by Brian Shilhavy

Editor, Health Impact News

I publish it on November 9, 2022 in the evening. The DOW ended at -646.89 and the NASDAQ ended at -263.02 today, but in corporate news the headlines are still talking about the mid-term elections as this news about the fall in FTX is still developing

What will the markets do tomorrow when all those lost billions of dollars come crashing down on Wall Street investors?

The October Consumer Price Index (CPI) report is also due tomorrow, and if it brings bad news on inflation, we could see a bloodbath in the markets tomorrow (Thursday 19 November 2022 ).

by ZeroHedge News

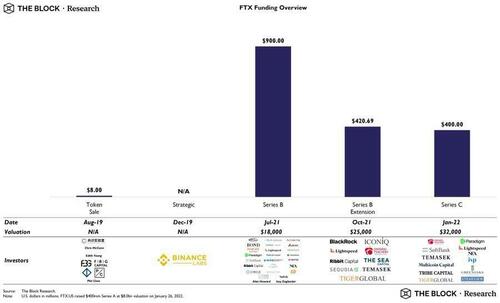

Now that the world’s largest crypto exchange, Binance, has walked away from a bailout of the world’s second largest crypto exchange, FTX, but the biggest crypto fraud ever, much bigger than MtGOX, here you have a list of all the “bright” investors whose money in FTX is now gone…all gone.

Let’s start at the top, where we find a who’s who of clueless momentum chasers, who over the years somehow got mistaken for credible and diligent investors: we’re talking, of course, about Tiger Global, which this it’s down 55% this year (and it’s about to drop a lot more) and, of course, the fund we once dubbed the bubble-era “cut of the century,” SoftBank.

I can’t make up for it: Among the January Series C investors in FTX who valued the ponzi scheme at $32 billion were Tiger Global (down 55% from the previous year) and Softbank.

— zerohedge (@zerohedge) November 9, 2022

One wonders how much of today’s widespread selling across asset classes was due to Tiger Global taking a margin call and leaving what it can?

There are more funds, of course: Third Point and Altimeter Capital Management are among the hedge funds that recently participated in funding rounds for Sam Bankman-Fried’s cryptocurrency exchange. Alan Howard of Brevan Howard Asset Management, the family office of Paul Tudor Jones and Millennium Management founder Izzy Englander also stepped in as angel investors, along with celebrities such as Gisele Bundchen and Tom Brady.

There were many others: FTX also attracted capital from the Ontario Teachers’ Pension Plan, Sequoia Capital, Lightspeed Venture Partners, Iconiq Capital, Insight Partners, Thoma Bravo and Masayoshi Son’s SoftBank.

Tiger Global and Ontario Teachers first invested in FTX in December 2019 in a funding round that valued the company at $8 billion, according to data from PitchBook. Both completed their bets in October 2021, giving FTX a $25 billion valuation, and did so again in January, the data show. Some of the other companies and individuals backed FTX in July 2021, paying cash to participate in a $1 billion funding round that valued the crypto exchange at $18 billion.

Do you prefer bullets? Here’s a list of the top investors in FTX courtesy of The Block’s Frank Chaparro:

BlackRock Ontario Pension Fund Sequoia Paradigm Tiger Global SoftBank Circle Ribbit Alan Howard Multicoin VanEck Temasek

Amazingly, as increasingly clueless pedigreed investors flocked to fund this fraud of epic proportions, the valuation became super parabolic, and after two early rounds in 2019 and 2020, FTX got its first real outside funding in July 2021 when it raised $900 million at an $18 billion valuation in its Series B round; this was followed by two more rounds, the most notable of which was the Series C when its valuation exploded to a staggering $32 billion. It was around this time that Scam Bankrupt-Fraud started calling sports stadiums and imagined a world in which FTX would buy Goldman.

The chart below is definitive proof that even (or rather especially) the smartest investor doesn’t do their homework before allocating large amounts of capital.

All of this has been going on for so long now that regulators are investigating whether FTX handled client funds properly (translation: the firm likely used client funds from its exchange to fund its trading shop, Alameda Research) and the company’s relationship with other entities that Bankman-Fried controls, and concerns raised by Binance executives during its due diligence process could torpedo the deal.

As a result of the FTX collapse, all of the aforementioned investors, among others, stand to lose all of their invested cash, especially with news like this hitting the tape:

* BANKMAN-FRIED TOLD INVESTORS FTX HAS DEFICIT UP TO MLS$8,000

Still, while billions will be lost, no one will be crushed more than Bankman-Fried himself, whose personal wealth has plummeted from $16 billion to what may now be a negative number in an hour. to account for your personal debt. Of course, it’s all downhill from there, especially once SBF is thrown in jail for stealing billions of customer funds on his exchange and using them not even to buy yachts, but to make catastrophically bad investments.

Read the full article at ZeroHedge News.

See also:

Understand the times we are currently living in

How to determine if you are a disciple of Jesus Christ or not

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

The end is near! Be firm!

Does your family think you’re “out of your mind”? You are in good company because Jesus confronted his family

What happens when a holy and just God gets angry? Lessons from history and the prophet Jeremiah

Drug-free healing: Western culture has lost its way

The most important truth about the arrival of the “new world order” Almost no one disputes it

Insider exposes Freemasonry as the world’s oldest secret religion and Luciferian plans for the new world order

Identifying the Luciferian Globalists Implementing the New World Order: Who Are the “Jews”?

Posted on November 9, 2022