source

Comments by Brian Shilhavy

Editor, Health Impact News

The Biden administration appears to be abandoning its “banking system is fine” rhetoric.

CNN reported today that Treasury Secretary Janet Yellen met with the CEOs of major banks yesterday and told them that “more bank mergers may be necessary.”

New York (CNN) – During Thursday’s meeting with CEOs of major banks, Treasury Secretary Janet Yellen told executives that more bank mergers may be necessary as the industry continues to navigate a crisis, two people told CNN familiar with the matter.

Yellen’s comments provide further evidence that Biden officials are beginning to embrace the idea of bank mergers despite concerns from progressives and administration scrutiny about corporate concentration. (Source.)

His remarks capped a stock rally this week that saw regional bank shares rise 10% in one of their best weeks since 2020.

Not anymore.

As ZeroHedge News reported today, reports show that billions of dollars in deposits have been lost at US banks in the past two weeks, with more than 70 billion dollars lost big US commercial banks.

After yesterday’s continued increase in flows to money market funds and increased use of the Fed’s bank bailout facilitiesExpectations were for more deposit outflows from US commercial banks (despite comments from the Western Alliance that sent shares of regional banks plunging this week.

However, Treasury Secretary Yellen somewhat spoiled the match today by warning (according to me) that the market should expect “more bank mergers” (ie failures)…

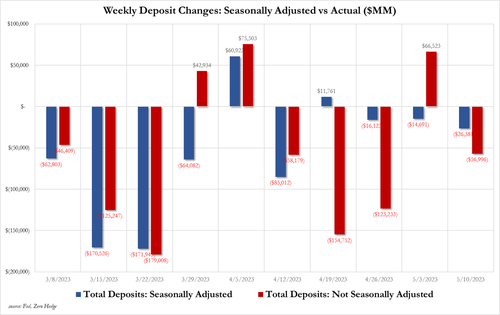

And so, according to the Fed’s latest H8 report, on a seasonally adjusted basis, total US commercial bank deposits fell by $26.4 billion in the week ended 10/5, the third week in a row…

Source: Bloomberg

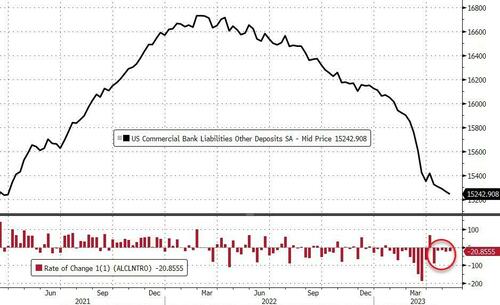

In one Seasonally adjusted, US commercial bank deposits (ex-large term deposits) decreased by $20.8 billion last week (through the 5/10 weekend), for the fifth consecutive weekly outflow. It is the lowest since March 2021…

Source: Bloomberg

In one Not seasonally adjusted, U.S. commercial bank deposits (ex-large term deposits) fell $50.26 billion (after jumping $63.8 billion) the previous week

And judging by yesterday’s money market inflows, deposit outflows continued this week (remember that deposit data is one week behind money market and Fed balance sheet data), despite assurances from WAL…

Source: Bloomberg

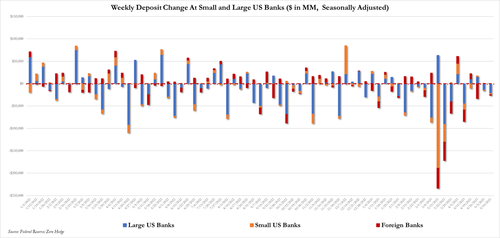

In one seasonally adjusted basis (eg large term deposits), Big, small and foreign banks all saw exits last week. Small bank deposits are at their lowest level since May 2021…

Source: Bloomberg

This is the fifth straight week of small bank exits, and small banks saw the biggest exits…

Big banks: SA$7.49 billion (-$36.5 billion NSA)

Small banks: SA$8.742 billion (-NSA$12.5 billion)

Foreign banks -SA$4.627 billion (NSA -$1.2 billion)

Source: Bloomberg

Including large term deposits, the breakdown is as follows:

Large banks – $21.6 billion Small banks – $2.7 billion Foreign banks – $2.1 billion

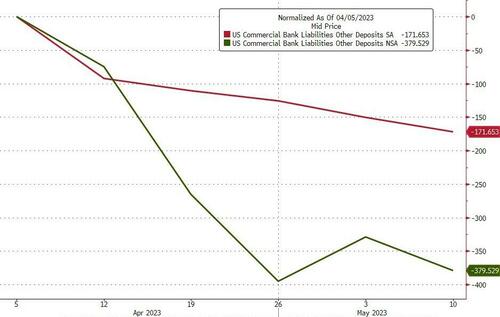

Finally, after adjusting for all the reviews (which are now weekly), what stands out to us is that the last 5 weeks saw $379 billion in bank outflows from the NSA, while the SA figure is an outflow of just $171 billion.

Source: Bloomberg

So The Fed says there are still more than $200 billion in tax-related deposits that are expected to return to banks.

Source: Bloomberg

The Fed’s report showed that residential real estate loans declined by a seasonally adjusted $2.6 billion, while commercial property loans rose slightly. Consumer loans also increased from the previous week, while commercial and industrial loans fell $3.5 billion.

On the other side of the ledger, commercial bank lending was little changed in the week ended May 10, according to seasonally adjusted data. Large bank loans fell $6.159 billion, while small bank loans rose $6.85 billion (despite strong deposit outflows)…

Source: Bloomberg

Full article

As I wrote yesterday, the entire stock market is now held up by a few Big Tech companies, and every day I’m reading new reports about how disastrous this could be, because Big Tech is just moving money around right now and trying to . to participate in the fashion of AI.

For example, consider the $10 billion deal Microsoft paid OpenAI to start using ChatGPT. $10 billion went on OpenAI’s books as a profit, but on Microsoft’s books it was entered as a loss.

For the US economy, this is a net zero until Microsoft starts making a profit and getting revenue for what they paid to use ChatGPT and started giving it away to the public for free.

Microsoft has huge cash reserves, so they could afford to do something like this, and by giving it away for free, they put pressure on their competitors, especially Google, to rush out and launch their own AI chat software.

How long will it take for Microsoft to start seeing profits with revenue that will benefit the global US economy?

Here’s what Goldman’s sales and trading table says about how long it will take to start seeing benefits from chat AI investments:

While we’re big fans of AI and Chat-GPT ourselves, we tend to be skeptical of significant productivity gains over short time horizons from any new technology.

Even if the new technology can benefit from an existing delivery infrastructure and educated recipients, it should be at least a decade to begin to have a significant impact on a large economy.

Over long horizons, the productivity increases of a new technology are temporary, as high wages in the more productive sector, in the presence of redistributive taxation, are pushing wages in the less productive sectors higher and the more productive sector it is reduced in relative size of employment and also in relative employment. the size of the economy (this is known as the Baumol effect – see Hartwig, Jochen (2001) – “On misinterpreting the ‘Baumol Disease'”).

As less productive sectors gain employment, average productivity declines to a possibly even lower level. (Source.)

These are actually pretty basic economic principles, but when you look at what investors are doing right now, you have to wonder if this frenzy that is leading to uninformed and emotional economic decisions (mostly fear) isn’t part of a bigger plan. broad, to intentionally cause an economic collapse for the purpose of consolidation, both in the banking and technology sectors.

Related:

See also:

Understand the times we are currently living in

Who are the children of Abraham?

The Brain Myth: Your intellect and thoughts originate in your heart, not your brain

God will not be fooled: a person reaps what he sows

An invitation to technologists to join the winning side

The God of All Comfort

Fact Check: “Christianity” and the Christian religion are NOT found in the Bible – the person Jesus Christ is

How to determine if you are a disciple of Jesus Christ or not

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

What happens when a holy and just God gets angry? Lessons from history and the prophet Jeremiah

Insider exposes Freemasonry as the world’s oldest secret religion and Luciferian plans for the new world order

Posted on May 19, 2023