for Brian Shilhavy

Editor, Health Impact News

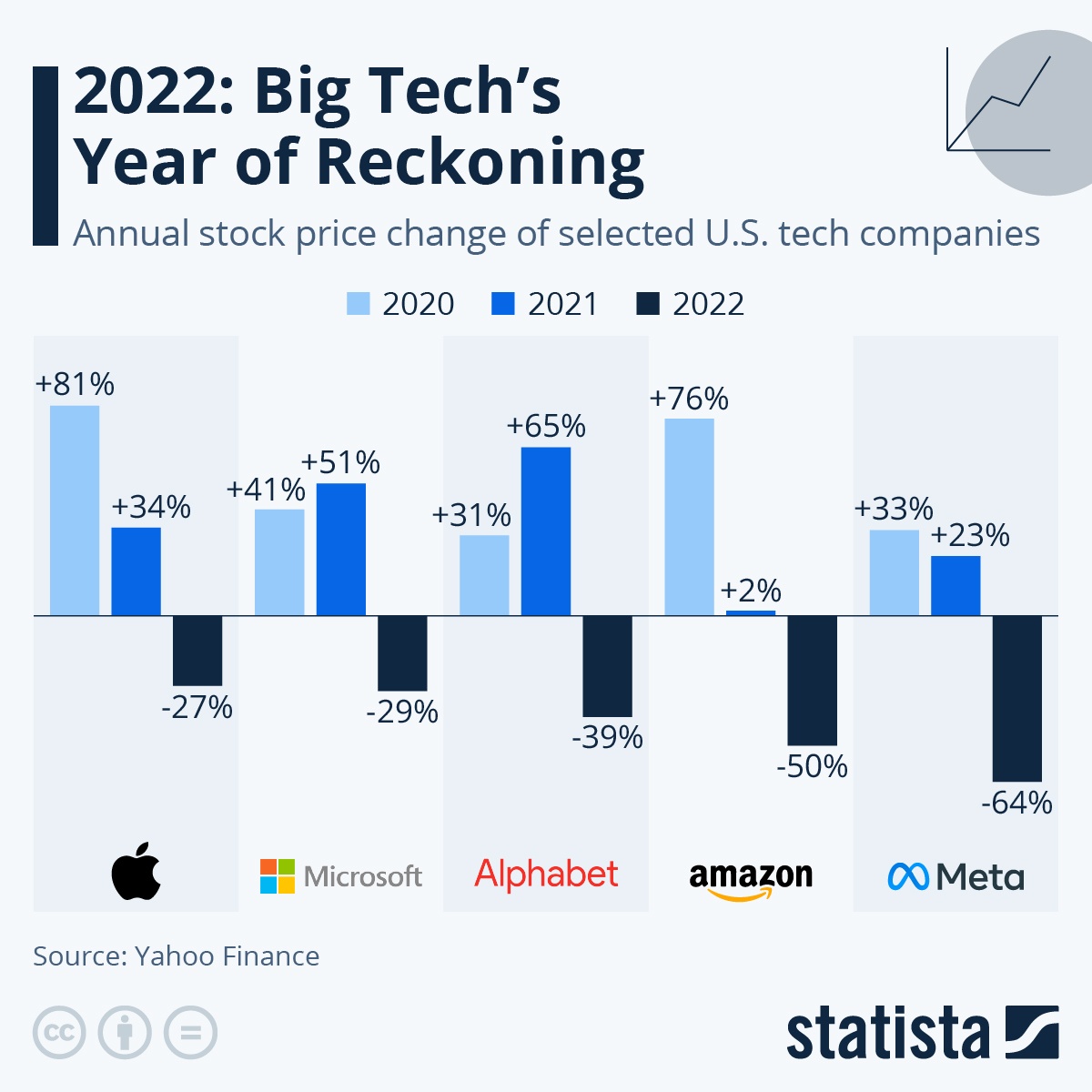

I’ve been reporting on the Big Tech Crash since it started last year (2022).

source

This crash picked up speed in 2022 after the collapse of mega-cryptocurrency firm FTX, which revealed a massive criminal Ponzi scheme that raked in billions of dollars while its founder and associates reveled in the his wealth with drugs, wild parties and sexual orgies. (Source.)

NBA star Shaquille O’Neal finally receives FTX-related lawsuit, ending 3-month pursuit. (Source.)

Criminal and other civil proceedings are still ongoing, and we may never know how far this scandal went and the scope of those involved, which includes many famous figures in professional sports. The Miami Heat NBA basketball team’s arena was even named after FTX and recently had to change its name right after FTX bought a multi-year sponsorship of the arena.

Here in 2023, however, investors have continued to pour money into Big Tech stocks, despite the losses they suffered in 2022 and hundreds of thousands that have now been fired by these companies, and I’ve been warning for the last 3 months that this is a huge financial bubble because most of these investments are getting into the latest Big Tech fad: the models of artificial intelligence large-dimensional language (LLM), such as ChatGPT, despite the fact that these new software products do not yet generate any revenue.

And in a report released today on an analysis by JPMorgan, the analysis stated that “Interest in artificial intelligence powered by ChatGPT and other large language models has driven more than half of the S&P 500’s gains this year”.

WOW!!! This is worse than I expected! Not only is Big Tech in trouble and on the brink of collapse, so is the entire US financial system.

History repeats itself, but this time it is much worse

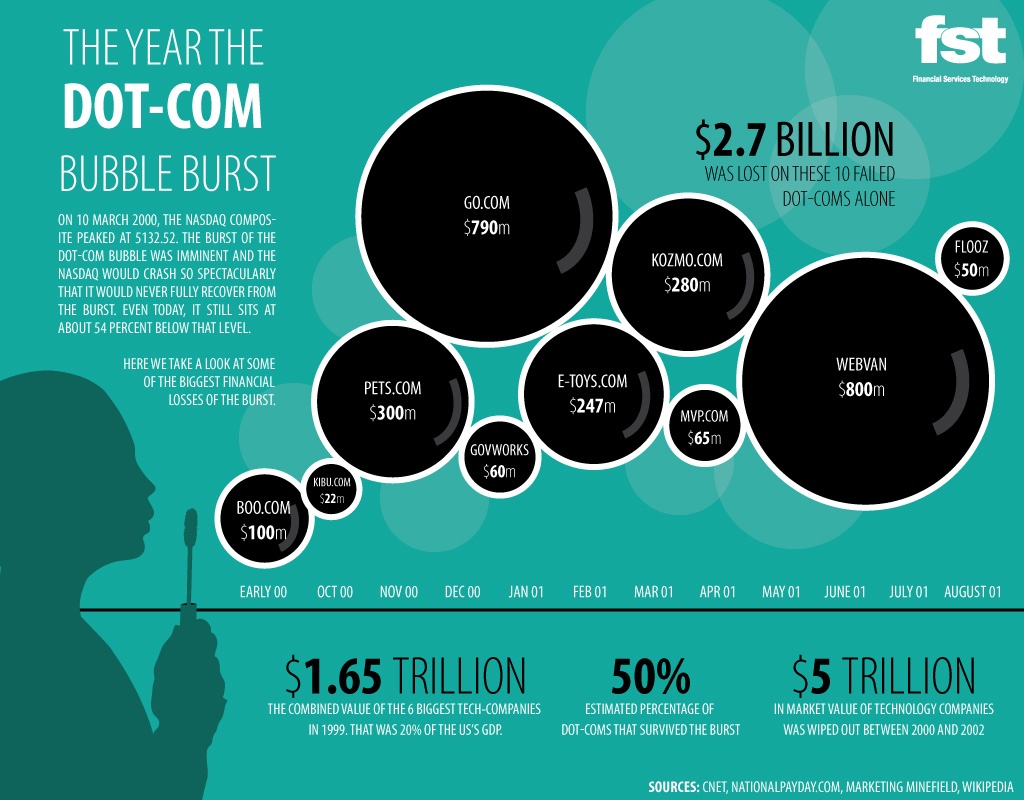

We’ve been here before, in 2000 and 2001, when the last Big Tech bubble burst in what is commonly known as the “dot com” financial bubble.

But most of the people running Big Tech today are probably too young to know, and who even studies history these days when you can walk into Big Tech and hop on the Big Money gravy train without even producing nothing?

This is exactly what was happening in the late 1990s when the first Big Tech bubble formed. I was there and started my own dot-com e-commerce company, which is still around today 21 years later.

Brian McCullough wrote a great review of the dot-com bubble of 2000 in 2018 for TED.com. Here are some excerpts, and as you read this, note the similarities to the current Big Tech bubble.

A revealing look at the dot-com bubble of 2000 and how it shapes our lives today

The dot-com hits of the late ’90s and early ’00s had a few things in common: they all promised to “change the world,” had crazy ratings, and weren’t profitable.

In 1999, losing money was the mark of a successful dot-com. And few could lose money as prolifically or creatively as Priceline. The head of a rival website called CheapTickets complained that his company couldn’t compete with Priceline’s hype. “We have a policy here at CheapTickets,” said founder Michael Hartley. “We have to make money. It hurts our rating.”

Many of the companies that would embody what we think of when we think of the dot-com bubble—Pets.com, eToys, Kozmo.com, UrbanFetch—shared some or all of Priceline’s traits: a business plan that promised to “change the world “; a Get Big Fast strategy to reach ubiquity and corner a certain market; a tendency to sell products at a loss to gain that market share; willingness to spend heavily on branding and advertising to create awareness; and a very high stock market valuation that was divorced from any kind of profitability or rationality.

It became a running joke that the dot-coms that started out promising a grand vision for a more efficient way of doing business were, almost to a company, unprofitable. It’s entirely possible that many of them focused on the real efficiencies that online selling made possible and thus slowly became sustainable businesses. But that wasn’t the name of the game in the late nineties.

The venture capitalists who backed these companies targeted supernova IPOs because that’s when they got paid. Any IPO meant an exit for venture capitalists.

Those amazing day one “pops” who experienced dot com stocks when they went public? This was the first collection of money, selling its shares to the investing public.

The dot-com bubble was a fantasy period when many VCs didn’t care if a company made a profit, because it didn’t need to. “We’re in an environment where the company doesn’t have to be successful for us to make money,” admitted a Benchmark venture capitalist when reflecting on a pre-IPO investment in Priceline.

In October 1999, the market capitalization of the 199 Internet stocks tracked by Mary Meeker of Morgan Stanley was a whopping $450 billion. But the total annual sales of these companies came to only about $21 billion.

And their annual profits? What benefits? Collective losses totaled $6.2 billion.

“People come in here all the time and say, ‘The last thing I want to be is profitable,'” boasted one investment banker in June 1999. “‘Cause then you wouldn’t get the valuation of an Internet company. ‘.” (Read the full article here.)

So here we are in 2023 with pretty much the same thing happening, inflating another huge financial bubble fueled by Big Tech, except this time. it’s much worse!

In 2000, the technology was still in its infancy and was primarily in the technology sector of the economy. The top 10 tech stocks in 2000 accounted for about 23% of the total S&P market capitalization.

Today, Big Tech makes up about 35% of the S&P 500 ( source ), but that doesn’t even begin to tell the real story of tech investing, as its products are now used by almost every other sector of the US economy, as ‘biotech’, ‘fintech’ and other similar terms are commonly used today to describe the growing influence of technology throughout the US economy.

And they ALL want in on the latest Big Tech fad: ChatGPT-type AI software.

Like all Ponzi schemes, it can take a while for the US economy to implode and reflect on the US stock market, which has basically become one big Ponzi scam.

Big Tech’s first-quarter reports are out this week, and while they’ll no doubt reflect big financial losses, they’re riding the AI train as much as they can by betting on the future.

For example, I expect these reports to show some growth in some sectors, such as Cloud Computing, where demand increases to supply the computing power needed to develop all this AI software, and that will be enough for Wall Street investors to bet. the future and keep pumping money into this Ponzi scam.

But it will eventually fail, as the banks fail, and eventually there will be no more money left to continue funding the fraud.

Wall Street billionaires and bankers will then step in and likely use the Federal Reserve to “manage the crisis” and determine which tech companies are too big to fail, and then put American taxpayers on the hook to bail them out.

The same will also happen with the banking sector, and on the other side of this crash there will be only a few technology companies that manage the entire technology sector, and only a handful of banks that everyone will be forced to pay. .

This will make it much easier to monitor every aspect of the American public as they implement digital IDs and tracking for everyone and eventually central bank digital currencies.

Related:

WARNING: Faith in Artificial Intelligence Is About to Destroy America: Total System Collapse May Be Imminent

Will America’s Addiction to IT Be Its Downfall?

See also:

Understand the times we are currently living in

The God of All Comfort

Year 2023: Will America Fulfill Its Destiny? Jesus Christ is the only “transhuman” the world has seen or will ever see

An invitation to technologists to join the winning side

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

How to determine if you are a disciple of Jesus Christ or not

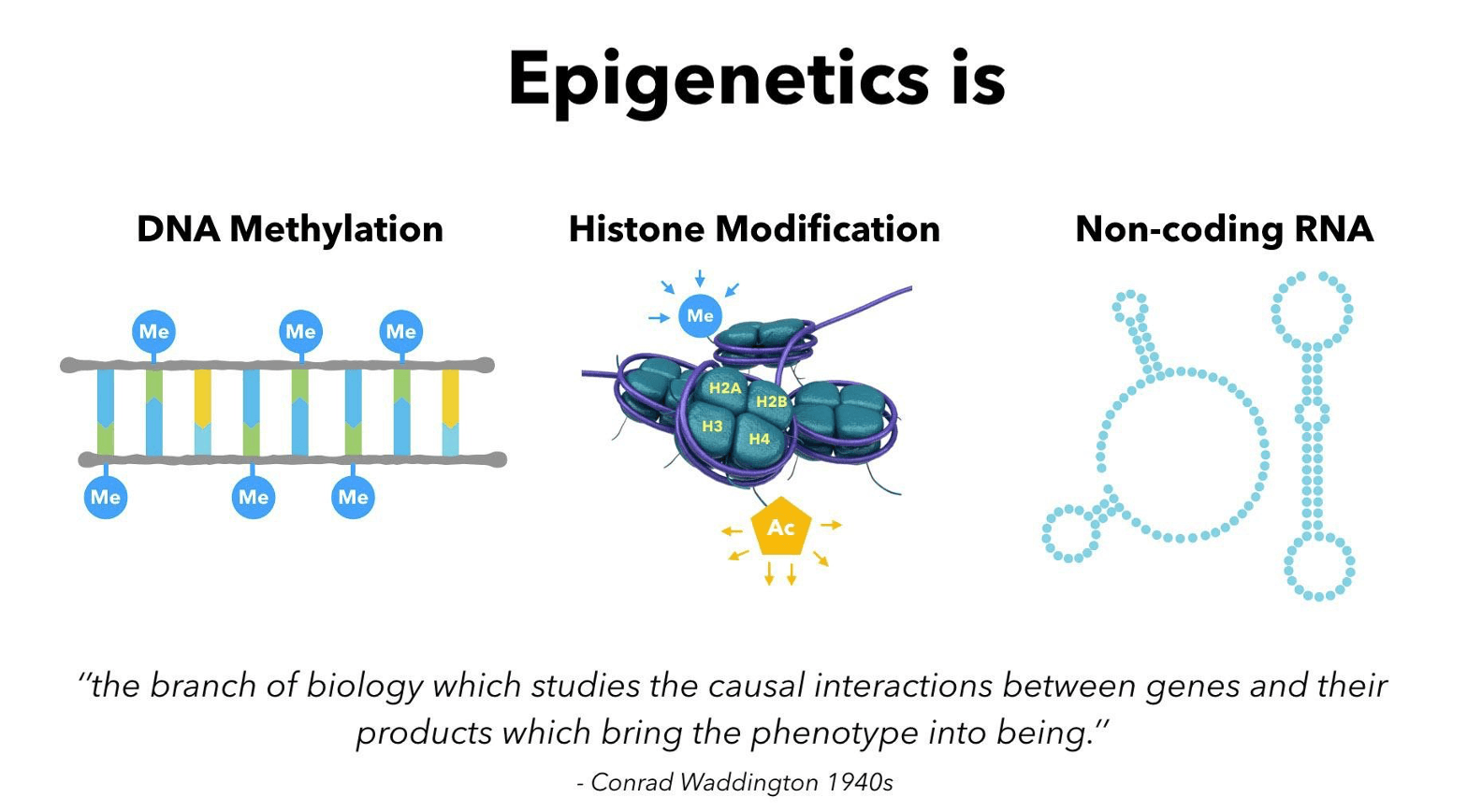

Epigenetics exposes Darwinian biology as religion: Your DNA does NOT determine your health!

What happens when a holy and just God gets angry? Lessons from history and the prophet Jeremiah

Insider exposes Freemasonry as the world’s oldest secret religion and Luciferian plans for the new world order

Identifying the Luciferian Globalists Implementing the New World Order: Who Are the “Jews”?

Posted on April 25, 2023