Here we go again: 60% of troubled California bank PacWest craters in report seeking buyers or capital raise

by ZeroHedge News

Earlier today, when Jerome Powell blatantly lied to the American people during the FOMC press conference by stating without a hint of irony that the US banking system is “sound and resistant”…

Federal Reserve Chairman Jerome Powell says “the American banking system is strong and resilient.”

what do you think 🤔pic.twitter.com/qDktlpOln4

— Human Events (@HumanEvents) May 3, 2023

… we opposed: How could this former lawyer lie so blatantly to the American people, the narrator wondered, when in the past few weeks we had seen more than half a trillion bank failures, making the current bank failure episode even more worse than the global financial crisis?

POWELL: THE AMERICAN BANKING SYSTEM IS SOUND AND RESISTANT

Narrator: We just had over half a trillion dollars in bank failures last month pic.twitter.com/YvhloFIGIX

— zerohedge (@zerohedge) May 3, 2023

Well, as usual, the narrator was right, because while Powell’s lies were still ringing in our ears, the next regional bank collapse was on the way.

Shortly after the closing, Bloomberg reported that another California-based regional bank (of course), PacWest Bancorp., was weighing a number of strategic options, including a sale.

The Beverly Hills-based bank, whose financial conditions appear to have been far worse than the Fed, which had just raised another 25 bps, has been working with a financial adviser and also considering a breakup or raise of capital, according to Bloomberg. sources Although it is open for sale, the company has not started a formal auction process.

According to the report, “an outright sale has been stymied because there aren’t many interested potential buyers across the bank, which includes a community lender called Pacific Western Bank and some commercial and consumer lending companies,” said the people And similar to SVB and FRC, “A potential buyer would also have to potentially record a large loss that would reduce some of its loans, the people said.“

PacWest fell 28% on Tuesday as investors pulled out of regional bank stocks after JPMorgan’s Monday deal for failed First Republic Bank, a deal that did nothing to ease concerns about the viability of regional banks, which was perfectly to be expected. as today’s rate hike would only make the regional bank deposit even bigger, which was obvious for all to see…

… except the Fed!

And sure enough, after the Bloomberg report, PacWest, which had $28 billion in deposits at last check (much less at this point) and $44 billion in assets, saw its shares fall more than 60% after hours…

Note that just a week ago, shares of PacWest jumped 17% after the mid-sized lender said deposits stabilized at the end of March and rose in April.

“Importantly, deposits stabilized in the latter part of March and rebounded nicely in April, increasing by approximately $700 million after the end of the quarter.” President and CEO Paul Taylor said in the statement

Tonight’s sad news comes six weeks after PacWest said it had bolstered its access to cash by raising $1.4 billion through a loan facility from Apollo-backed investment firm Atlas SP Partners .

According to its last public statement, PACW had done just that $29 billion in deposits (significantly smaller than SVB and FRC), but more problematic, more than three quarters of its loans are to real estate, and 8% in venture capital (with its venture capital business accounting for $6 billion in deposits at the end of March).

Things seem to have “escalated rapidly” since then.

The broad regional bank index is falling after hours, now at its lowest level since October 2020…

…and it’s dragging other regional banks down with it, especially anything with “west” in its name:

The Western Alliance is down 30%.

And while we’re shocked at this level of Fed incompetence: after all, just a few hours ago, Powell assured everyone that America’s banks are safe and sound…

This is an unprecedented humiliation for the @federalreserve.

Just 2 hours earlier, Powell said the U.S. banking system is “sound and resilient,” apparently unaware that another of California’s biggest banks was on edge.

How is this level of incompetence possible

— zerohedge (@zerohedge) May 3, 2023

… not even the Fed will allow this idiocy to continue, or else they will cut rates and inject trillions more in liquidity now that we are clearly facing the limit of small bank reserves…

Oh, the irony: JPM’s takeover of FRC (funded by FDIC/US taxpayers) drained $75 billion in reserves. And we are again at the critical threshold of the reserve constraint. So the banking crisis is baaaaack https://t.co/EvbkxvkOct

— zerohedge (@zerohedge) May 2, 2023

… or will have it a banking crisis on their hands the likes of which had never been seen before.

Read the full article at ZeroHedge News.

Related:

See also:

Understand the times we are currently living in

The God of All Comfort

Who are the children of Abraham?

God will not be fooled: a person reaps what he sows

An invitation to technologists to join the winning side

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

How to determine if you are a disciple of Jesus Christ or not

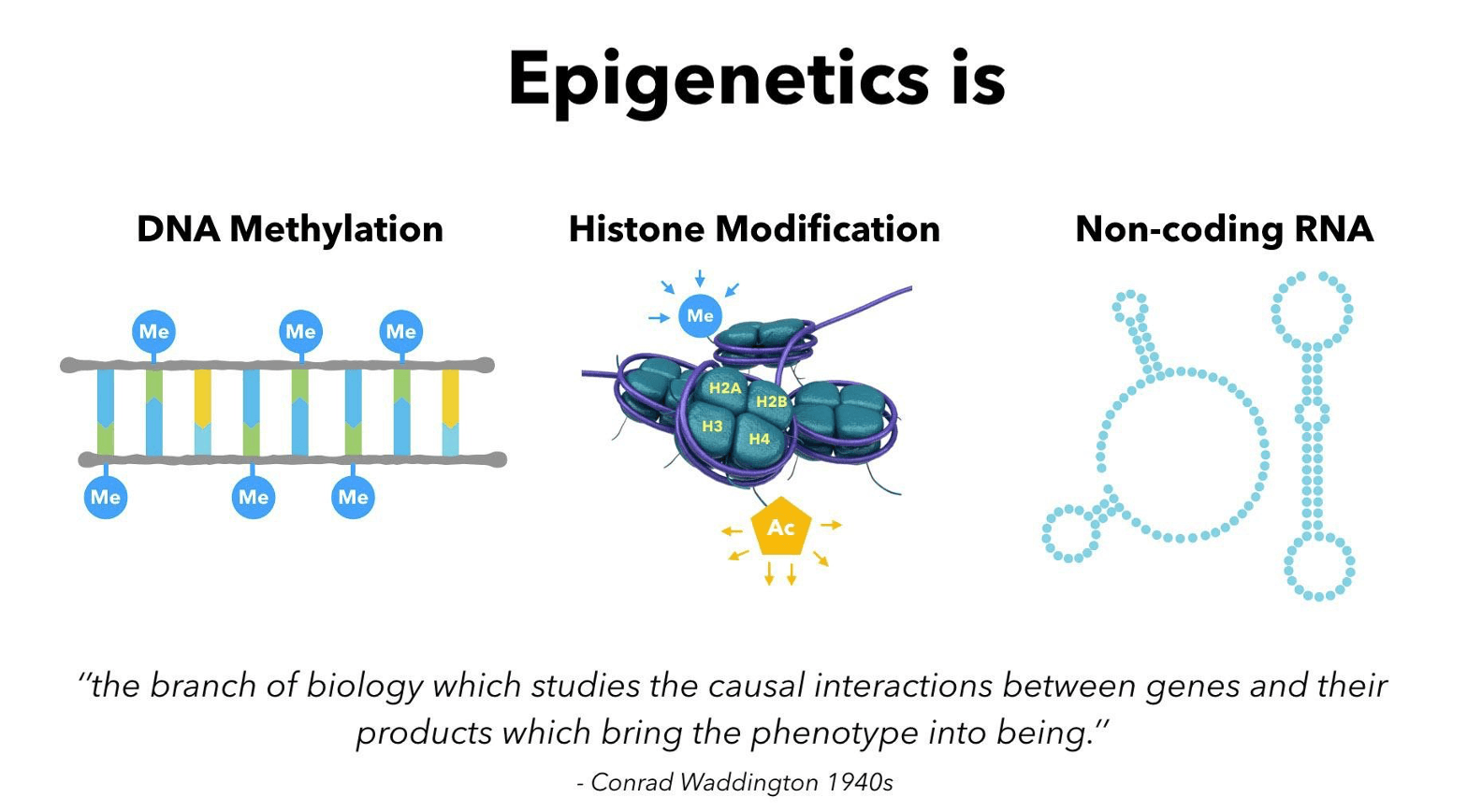

Epigenetics exposes Darwinian biology as religion: Your DNA does NOT determine your health!

What happens when a holy and just God gets angry? Lessons from history and the prophet Jeremiah

Insider exposes Freemasonry as the world’s oldest secret religion and Luciferian plans for the new world order

Posted on May 3, 2023