Buffett Turns Gloomy: ‘Amazing Period’ For US Economy Is Coming To An End

While Warren Buffett’s views on the economy are traditionally upbeat and upbeat, they tend to strike at moments of peak pessimism in the form of NYT op-eds or CNBC cartoons (and usually around the time the Omaha billionaire knows the government will back him TBTF investments, unlike almost anyone else’s) On Saturday, the head of Berkshire Hathaway had a far more unpleasant and gloomy prediction for his own businesses , and for the economy in general, the good times may be over.

Speaking at Berkshire’s annual general meeting in Omaha, Nebraska, the billionaire investor said he expected profits at most of the conglomerate’s operations will fall this year as the next economic downturn further slows business activity. He made his downbeat comments even as Berkshire reported a nearly 13% gain in operating earnings to $8.07 billion in the first quarter, up from $7.04 billion a year ago.

“Most of our companies will report lower earnings this year than last year,” Buffett, 92, told crowds of thousands at Saturday’s event, according to Bloomberg. For the past six months or so, the “amazing period” for the U.S. economy has been coming to an end, he said.

As Bloomberg notes, Berkshire is often seen as an indicator of economic health because of the expansive nature of its businesses ranging from railroads to power companies and retail. Buffett himself has said that Berkshire owes its success to the incredible growth of the American economy over the decades. but his prediction of a slowdown for his companies comes as turmoil at regional banks threatens to reduce lending as inflation and higher rates continue to bite.

Buffett’s business partner Charlie Munger, 99, who joined him on stage, said the tougher economic environment will also make it harder for value investors, who typically buy stocks which seem cheap compared to the intrinsic value of the companies.

“Get used to doing less,” Munger said.

Despite the broader pessimism, Buffett said he expects earnings from his insurance underwriting operations, which are less correlated with business activity, to improve this year. Berkshire already reported higher earnings at those companies, including auto insurer Geico, which swung to profitability after six quarters of losses.

Geico posted revenue of $703 million as higher average premiums and lower advertising spending contributed to the gain, even as claim frequencies fell, Berkshire said in a statement reporting its earnings on Saturday. This revival follows a difficult period for the subscription business as inflation hit the cost of materials and labor.

Geico has faced particular pressure from rivals such as Progressive, which Buffett has called “well run,” and Allstate, which had long used telematics programs to track drivers and encourage better behavior before Geico introduced the offer Geico’s profits also helped Berkshire’s insurance underwriting businesses post $911 million in profit compared with $167 million a year earlier.

Berkshire previously said it expected Geico to return to operating profitability by 2023, after achieving rate increases. Still, Geico remains a problem for Berkshire, with top-line growth in the quarter of less than 1% that “significantly lags its peers,” CFRA analyst Cathy Seifert said .

“I suspect that the rate hikes that are being carried out to offset claims cost inflation are being met with policy cancellations,” he said. “While the loss of unprofitable policies is not always a bad thing, it is not usually the policies and policyholders that leave.”

Other parts of the conglomerate were more successful, with Berkshire Hathaway Energy’s after-tax earnings falling 46.3% from the same time last year amid “lower revenue from U.S. regulated utilities, other energy businesses and real estate brokerage businesses.“Rail results were also weaker than expected due to lower freight volumes and higher operating expenses, according to Edward Jones analyst Jim Shanahan.

But at one of Berkshire’s best-known businesses, Brooks Running Co., CEO Jim Weber was skeptical of a sharp consumer downturn.

“With unemployment this low, it’s hard to believe we’re going to fall off a cliff into a consumer-level recession,” Weber said in an interview Friday before the meeting. “I wonder if this will be a recession in asset values.”

Other topics covered Saturday included Buffett’s succession, the banking crisis, the US debt ceiling crisis, the company’s investment in Occidental, Chna’s upcoming invasion of Taiwan and more:

Succession planning: Buffett named Greg Abel, 60, as his successor in 2021, and the vice president of non-insurance operations has had a more pronounced presence since then. On Saturday, Buffett reiterated that he was “100 percent comfortable” with the decision and even signaled a largely business-as-usual transition, for as long as that might be. “Greg understands capital allocation as well as I do. That’s fortunate for us,” Buffett said at the meeting in Omaha, Nebraska. “He’ll make those decisions, I think, very much within the same framework that I would make them. We’ve established that framework for 30 years.”

Western control: One analyst called it the biggest announcement of the day: Berkshire will not make a bid for full control of Occidental Petroleum Corp., the energy company it has been raising its bets on for months. Buffett’s comment likely helped temper speculation that Berkshire wants to own Occidental after it won approval from U.S. regulators last year to acquire up to 50 percent of the company. Buffett didn’t rule out buying more shares of the Houston-based company, adding that he may (or may not) pursue more purchases.

Banking turmoil: Buffett and Munger were so sure they would be questions about the recent banking turmoil that they jokingly carried banners with the prominent accounting classifications during the upheaval. One was labeled “available for sale,” while the other said “held to maturity.” On a more serious note, Buffett blamed the executives in charge of the failed banks, arguing that they should be held accountable for mistakes that were hiding “in plain sight.” He also called out the “messy” incentives in banking regulation, as well as poor messaging from regulators, politicians and the press to the American public about the disorder. Buffett pointed to First Republic Bank, the insolvent bank that last weekend was acquired by JPMorgan after it collapsed after offering giant non-government-backed fixed-rate mortgages that were interest-only for 10 years in some cases, which Buffett called “a crazy proposition.”… “He was doing it in plain sight and the world ignored it until it blew up,” Buffett said.

Debt ceiling: As lawmakers race to resolve a standoff over the U.S. debt ceiling, Buffett said he could not see how Washington would allow the U.S. to default on its debt, an outcome that would plunge the financial system into a crisis. Investors and politicians are focusing on whether or not the US government can avoid hitting its statutory debt ceiling and a potentially catastrophic technical default that could follow. Despite the impasse, Buffett reiterated his belief in America as an “amazing society” with “everything going for us.” Given the choice, he would still want to be born in the United States, he said.

Geopolitics, Taiwan: In the fourth quarter, Buffett cut his stake in Taiwan Semi just months after disclosing a major stake in a quick investment that spooked investors. Buffett said on Saturday that the company was one of the best-run and most important in the world, but he did not like the location, a reference to Taiwan amid rising tensions between the island and China. Buffett and Munger emphasized the need for smooth relations between the US and China and urged increased trade. While the two will be competitive, they will always have to judge “how far you can push the other without them reacting badly,” Buffett said.

Separately, Berkshire completed its cash pile and ended the quarter with $130.6 billion, up $2 billion from $128.6 billion at the end of the year. That means Berkshire benefits from interest income as the Fed keeps raising rates: “Our investment income is going to be a lot bigger this year than it was last year, and that’s built in,” Buffett told the annual meeting.

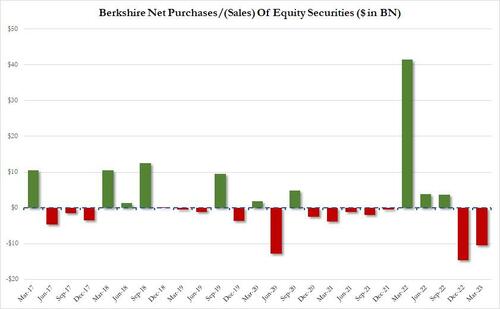

The company was also a net seller of shares for the second quarter in a row, pocketing $10.4 billion in net sales of shares ($13.3 billion gross) after deducting purchases of $2.9 billion.

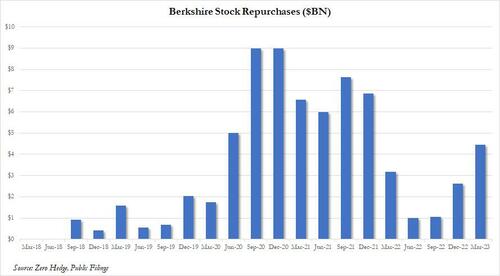

Berkshire ended up buying $4.4 billion in shares, up from the same period last year, as Bekrshire faced turbulent markets that offered fewer of the big deals it’s known for. Berkshire has been buying back more frequently as valuations in the public markets had made it harder for Buffett to identify promising acquisitions.