After an average 2-year auction and a stellar (albeit slightly down) 5-year auction, just moments ago the Treasury held its final coupon auction of the week when it sold $35 billion in paper of 7 years in a solid if forgettable sale.

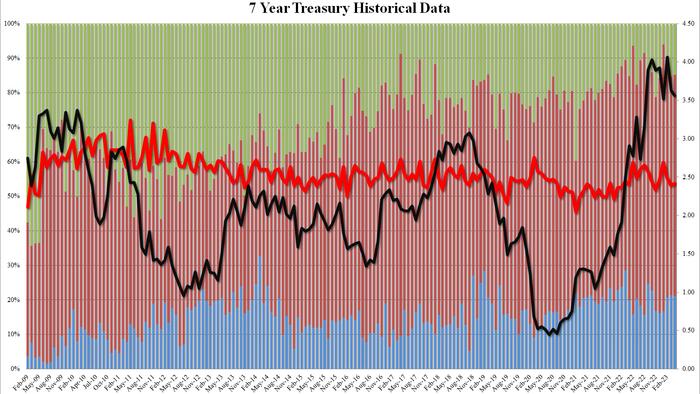

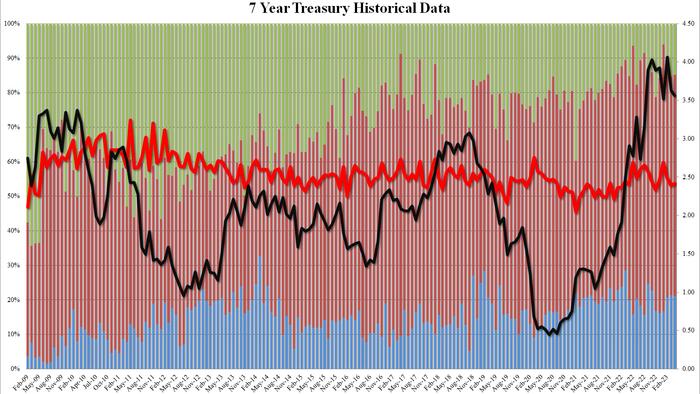

The auction stopped at a high of 3.563%, down from last month’s 3.626% and the lowest since January; extending the recent trend, the auction crossed 3.550% when issued in 1.3 bp. This was the third auction in a row of 7 years and 6 of the previous 7.

The cover bid of 2.415 was a slight improvement from last month’s 2.394 if it is below the six-auction average of 2.465.

Domestics were also average, with Indirects (foreign buyers) awarded at 64.11%, up from 63.2% in March but below the recent average of 66.5%; and with Directs up to 21.1%, the lowest since February but above the six-auction average of 19.1%, dealers were left with 14.8% of the auction, virtually above of 14.4% on average.

All in all, a solid auction that clearly benefited from the jump in yields throughout the day, which sent 10-year yields to 3.52%, or session highs, just in time for the auction.