Stellar demand for 5-year Treasury auction despite lowest yield since August" title="Stellar demand for 5-year Treasury auction despite lowest yield since August" />

Stellar demand for 5-year Treasury auction despite lowest yield since August" title="Stellar demand for 5-year Treasury auction despite lowest yield since August" />

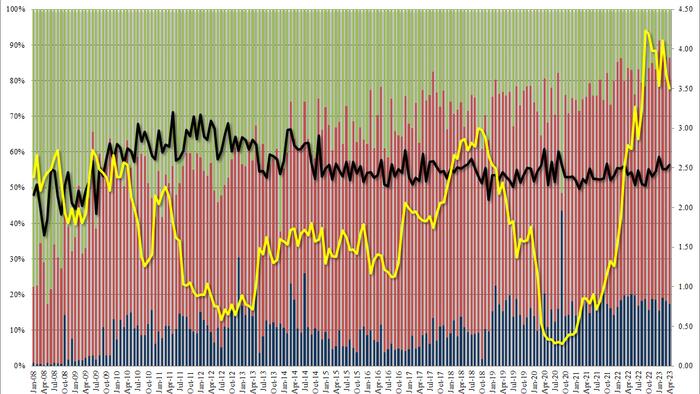

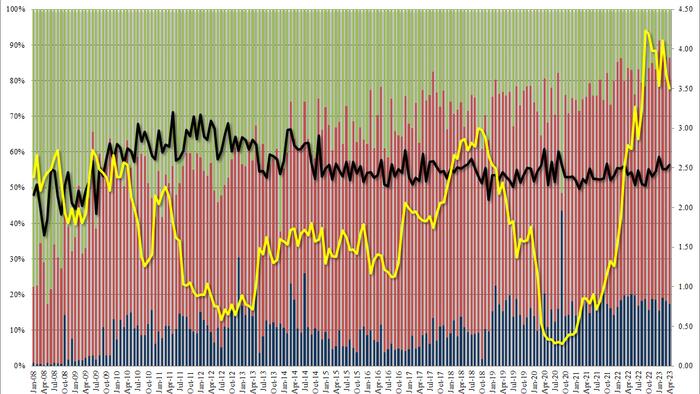

A day after a strong 2-year auction, just moments ago the Treasury sold $43 million in an even stronger sale of 5-year paper.

Resting at a high yield of 3.500%, it was not only below last month’s 3.665%, but was also the lowest 5-year yield since August 2022, when the tenor price was of 3.23%. It also stopped through the When issued 3.506% in 0.6bp, the second stop in a row.

The bid to cover was also strong, rising to 2.54, the highest since January and well above the six-auction average of 2.49.

Insiders were also strong, with indirects awarded at 69.1% of the auction, the highest since February and above the recent average of 68.8%. And with Directs down 17.3%, or just below the recent average of 17.3%, dealers were left with 13.6% of the auction, or above the six-auction average.

Overall, this was a very solid auction that took place just as the 10-year session highs hit, thus providing buyers with at least a modest concession.