Written by Lance Roberts via RealInvestmentAdvice.com,

An old adage says that investors should “sell in May and go.”

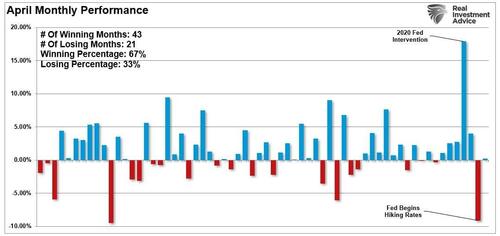

Historical analysis suggests that the market’s summer months tend to be the weakest of the year. The mathematical statistics prove this, as $10,000 invested in the market from November to April greatly exceeded the amount invested from May to October.

Interestingly, peak markdowns are significantly greater during “Sale in May” periods. Previous significant dates for major market declines occurred in October 1929, 1987 and 2008.

However, not all summers perform poorly. Historically, there are many periods when “Sell in May” didn’t work and markets went up. 2020 and 2021 were examples where massive Federal Reserve interventions pushed prices higher in April and the summer months that followed. However, 2022 was the opposite as it declined sharply in April as the Fed began an aggressive rate hike campaign the previous month.

As the end of April approaches, will 2023 be another year where the “Come in May” strategy works? While no one knows the answer, historical statistics, current economic indicators and technical measures suggest caution is warranted.

An investment of liquidity

Before discussing where we currently stand, a quick review of the above analysis is in order for context.

We discussed that correction after the strong rally in January it had probably started in February.

“Over the next few weeks, the ‘pain trade’ will likely be lower as the correction continues. If the bulls win this battle, these crucial support levels will hold. If not, we will likely begin a deeper decline to as bearish fundamentals take over.”

In fact, the bears took control and the markets fell in mid-March. Then we wrote “Bullish Buy Signals Mark 4200 for Relief Rally”.

“Despite this, With these buy signals in play, investors should modestly increase equity exposure as the likely path for stock prices is higher over the next two weeks to two months. As shown, the most likely target for the S&P 500 is 4200 before serious resistance is found and a reasonable level to take profits and reduce risk again.”

Although the market did not rise to 4200, it came close and peaked at an intraday high of 4168.

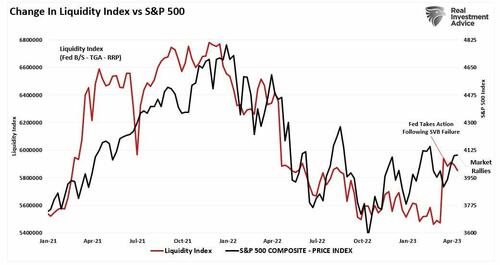

Another support for this rally came from the Fed’s bailout of banks after the failure of Silicon Valley Bank. As discussed in “No QE”, these loans to the banks were not technically QE. However, from the market’s perspective, the increase in the Fed’s balance sheet was “the ringing of Pavlov’s bell.”

“Another way to look at this is through measure of Fed balance sheet liquidity, less the general Treasury account, less the Fed’s reserve program. This combined measure has a decent correlation with market swings.”

The chart below is annotated and updated from this report. Not surprisingly, given the historical correlation between the liquidity index and the S&P 500, the market rallied in response to increased liquidity. As we approach the “May sell” period, this liquidity ratio is declining and is likely to fall further as the Treasury and the Government battle over the looming debt ceiling.

As noted, not only is the liquidity reversal suggesting that the May sell-off may be prudent, but so are the technical and economic indications.

Indicators suggest caution

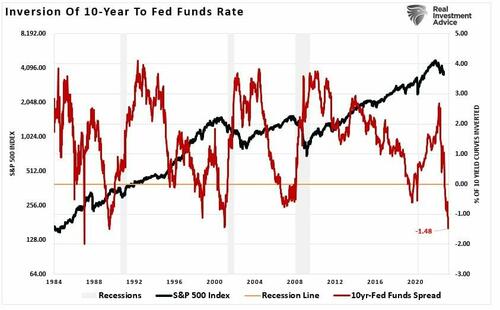

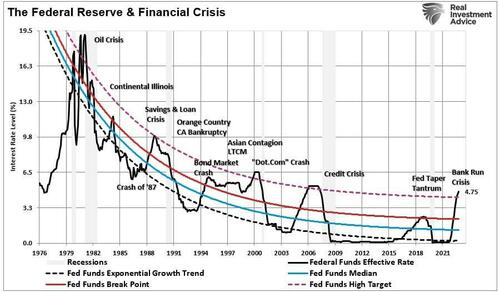

In the last one Bull Bear Report, I commented that many indicators are certainly worrying and suggest that an “official” economic recession is likely. The inversion of the 10-year Treasury federal funds rate is the most inversion since 1986 (about 10 months before the 1987 market crash).

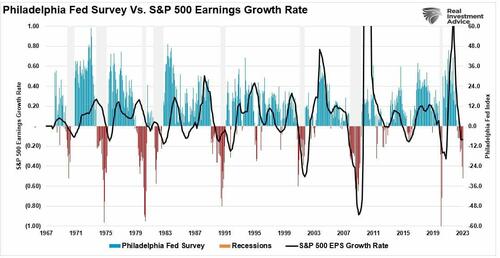

Also, the most recent release of the Philadelphia Federal Reserve’s manufacturing index showed a sharp drop in sentiment, suggesting a steeper correction than the gains currently represent. Historically, such deep readings in the “Philly Fed” index have been associated with harder economic recessions, not softer ones.

However, in the short term, it is the technical price action that we pay the most attention to. This is because price action represents market psychology. These technical indicators were the main drivers for reducing exposure to the markets in February and increasing again in March. The vertical lines represent each “buy” and “sell” signal over the past year.

While these signals are not “all in or all out” time indicators for the market, they have consistently provided good signals to increase and decrease equity risk exposure accordingly.

These indicators suggest that investors may be well served to “sell May” and return later.

The Fed has started raising rates

While the technical cues may be warning enough on their own to reduce risk heading into May, it’s worth remembering that the Fed will raise rates again on the 5th. With each rate hike, we’re getting closer to the Federal Reserve breaks something economically or financially. This has been the case repeatedly throughout history and given the aggressiveness of the rate hike campaign over the past year, a negative outcome would not be surprising.

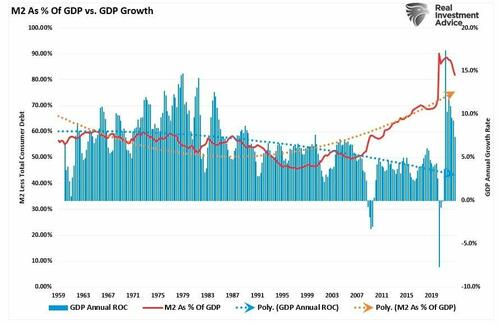

So far, markets have weathered the rate hike much better than expected. However, most of these rate hikes have not yet worked their way through the economic system. In addition, the economy has remained buoyed by the massive increase in the money supply, which still underpins economic activity. But that support is also fading as the last vestiges of pandemic support programs run out.

As we enter the traditionally weak summer months, we should note that the market’s uptrend remains intact. However, as I concluded this past weekend:

“A correction must be acknowledged and expected. A 10% drop would lead to another retracement to the lows of the uptrend channel as noted above. If this support holds, this would be a logical place to add exposure to risk assets from a purely technical perspective.”

A correction must be acknowledged and expected. A 10% drop would lead to another retracement to the lows of the uptrend channel as noted above. If this support holds, this would be a logical place to add exposure to risk assets from a purely technical perspective.

For these reasons, we have increased cash and reduced equity risk in the portfolios as we head into the seasonally weak summer months. Could we make a mistake in “selling May” and leave until later? It’s certainly possible, and if so, we’ll add exposure accordingly when necessary.

However, being cautious heading into summer can pay extra dividends.