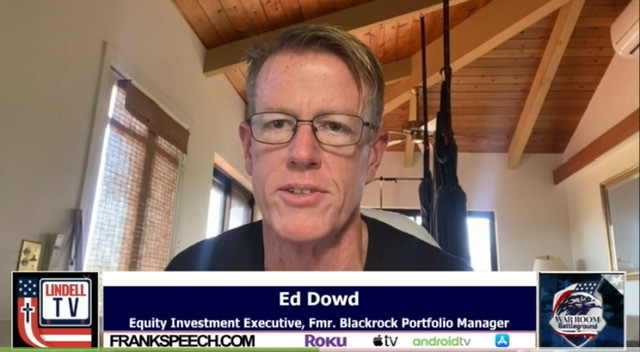

Ed Dowd: “We’re in a crisis, and the crisis is now starting to manifest in bank failures.”" title="Ed Dowd: “We’re in a crisis, and the crisis is now starting to manifest in bank failures.”" />

Ed Dowd: “We’re in a crisis, and the crisis is now starting to manifest in bank failures.”" title="Ed Dowd: “We’re in a crisis, and the crisis is now starting to manifest in bank failures.”" />

Ed Dowd is a seasoned banker with over three decades of experience in the industry. He has seen the ups and downs of the economy and has served through times of growth and recession. As the CEO of a community bank, Dowd understands the importance of stability and security in the financial sector.

Today, he believes that we are in a crisis, and that crisis is beginning to manifest in bank failures. In an interview with a local news outlet, Dowd expressed his concern over the current state of the economy and the potential for widespread financial turmoil.

According to Dowd, the problem lies primarily in the lending practices of banks. He notes that many institutions have taken on risky loans and investments in an effort to increase profits, but these actions have left them vulnerable to market fluctuations and economic downturns.

Additionally, Dowd points out that the current low interest rate environment is also putting pressure on banks. With interest rates at historic lows, many institutions are struggling to generate income and maintain profitability.

The combination of these factors has led to an increase in bank failures across the country. Dowd warns that this trend is likely to continue without significant changes in the banking industry.

To address this crisis, Dowd suggests that regulators need to take a more proactive approach. He advocates for stricter lending standards and regulations to ensure that banks are not taking on unnecessary risks. Dowd also calls on the government to provide support to struggling institutions to help prevent further failures.

Despite the challenges facing the banking industry, Dowd remains optimistic about the future. He believes that with the right policies and practices in place, the economy can recover and thrive once again.

As a respected leader in the banking community, Ed Dowd’s insights and experience are valuable in understanding the current state of the financial sector. His warning about the crisis facing the industry should serve as a wake-up call for all those involved in banking and finance, and his suggestions for solutions should be taken seriously to prevent further damage to the economy.