Displacement The Fed may be killing the private sector to save the government

Written by Daniel Lacalle,

The Federal Reserve’s balance sheet reached its all-time high in May 2022.

Since then, it was supposed to decline at a steady rate and should lose three trillion US dollars by 2024.

The normalization of monetary policy was built on the idea of a soft landing for the economy. However, the Fed may be killing the private sector to save the government.

Curbing inflation requires a significant reduction in the money supply and aggregate demand. However, if government deficit spending is not touched, the full burden of monetary policy normalization will fall on households and businesses.

The current situation is the worst possible.

The Fed’s balance sheet isn’t falling as fast as it should be; government spending has not even been scratched, but the The money supply is falling at the fastest rate since the 1930sand rate hikes are hurting the productive economy, while the government seems oblivious to the need to reduce its bloated budget.

The GDP figure for the first quarter is very worrying.

Public spending showed another big increase of +4.7%, much higher than expected. However, consumption, at +3.7% annualized, was well below estimates and driven by a worrying new record of credit card debt.

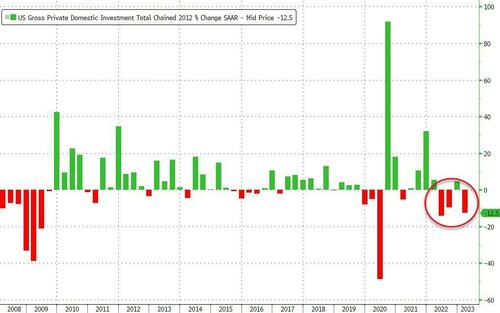

Even more worrying, Gross private domestic investment fell by 12.5%.

There is strong evidence of a negative trend in the real economy.

Increased federal spending, more red tape, higher taxes and weaker activity in the part of the economy that drives growth and jobs

Rate hikes have two direct negative effects on the economy if the government does not reduce its deficit. They involve higher taxes and a massive elimination of available credit. The government deficit will always be financed, albeit at higher rates, but this also means less credit for businesses and households. The crowding out effect of the public sector on the productive economy means lower productivity growth, weaker investment and lower real wages as the government keeps inflation above target by spending additional units of newly created currency, but the productive sectors find it more and more difficult. to find credit. In addition, the government borrows at a much lower cost than even the most efficient and profitable businesses.

It is impossible to achieve a soft landing for the economy when the Federal Reserve ignores signals from the banking system and the real economy. The first pillar of a true soft landing must be to preserve the real disposable income of workers and the job creation and investment capabilities of business.

When the government continues to increase spending, there is no sign of softer budgetary control, and all the “landing” comes from the private sector, what we get is an upside-down economy.

The Federal Reserve has stopped paying attention to monetary aggregates just as the money supply is contracting at an almost historic rate. Even worse, the money supply is shrinking, but federal deficit spending was untouched and the debt ceiling was raised again.

The money supply collapses due to the inevitable credit crunch and the difficulties faced by consumers and businesses.

It is impossible to grow with increased taxes, persistent inflation—a tax in itself—and the full burden of monetary policy normalization.

Fighting inflation without reducing government spending is like cutting weight without eliminating fattening foods.