And so, the era of closed money is over

by John Rubino

At the start of last week, everyone expected central banks to “strain until something breaks”. By the end of the week it was clear that they had already broken everything.

Two American banks imploded, European megabank Credit Suisse finally died a well-justified death, and “who’s next?” speculation ran high. And so the era of tight money ended.

Now the world’s monetary authorities have expanded the definition of “systemic risk” to cover pretty much anything. FDIC insurance has been extended to all bank accounts of any size. Credit Suisse is being bought for pennies on the dollar by rival Swiss giant UBS. And according to Bloomberg,

The Federal Reserve and five other central banks on Sunday announced a coordinated move to increase liquidity in US dollar swap agreements, the latest effort by policymakers to ease growing strains in the global financial system.

Central banks involved in dollar swaps “will increase the frequency of maturity operations to seven days from weekly to daily,” the Fed said in a statement coordinated with the Bank of Canada, the Bank of England, the Bank of Japan and Central Europe. Bank and the Swiss National Bank.

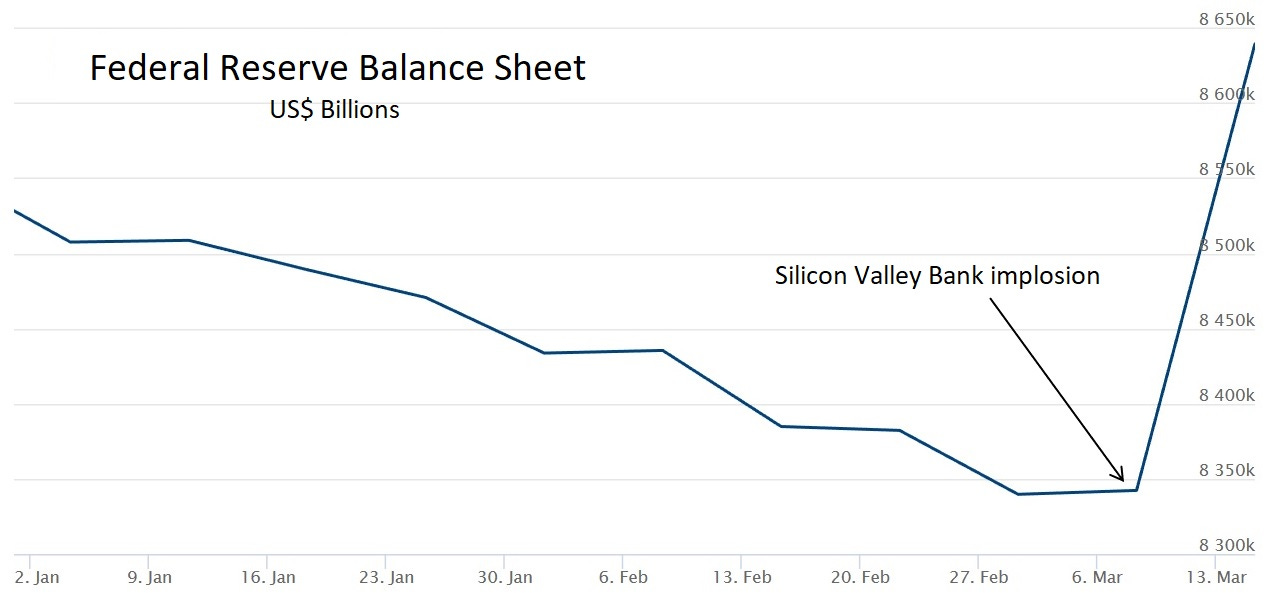

The Fed’s balance sheet, a measure of how much money it creates and pours into the economy, had been shrinking, meaning the US money supply had been shrinking. Now it’s skyrocketing, $300 billion in a matter of days.

The piecemeal nature of this response can be explained in two ways: either the morons running the global financial system were completely blind to the fact that they actually thought that rising interest rates and a fall in the money supply would slow inflation without unintended consequences, despite a century of experience to the contrary. Or the evil geniuses who run the global financial system have engineered a multifaceted crisis as an excuse to assume total control.

I’m agnostic about the above, but in any case, it seems clear that the governments of the world will not be able to stop conditions from deteriorating. Consider:

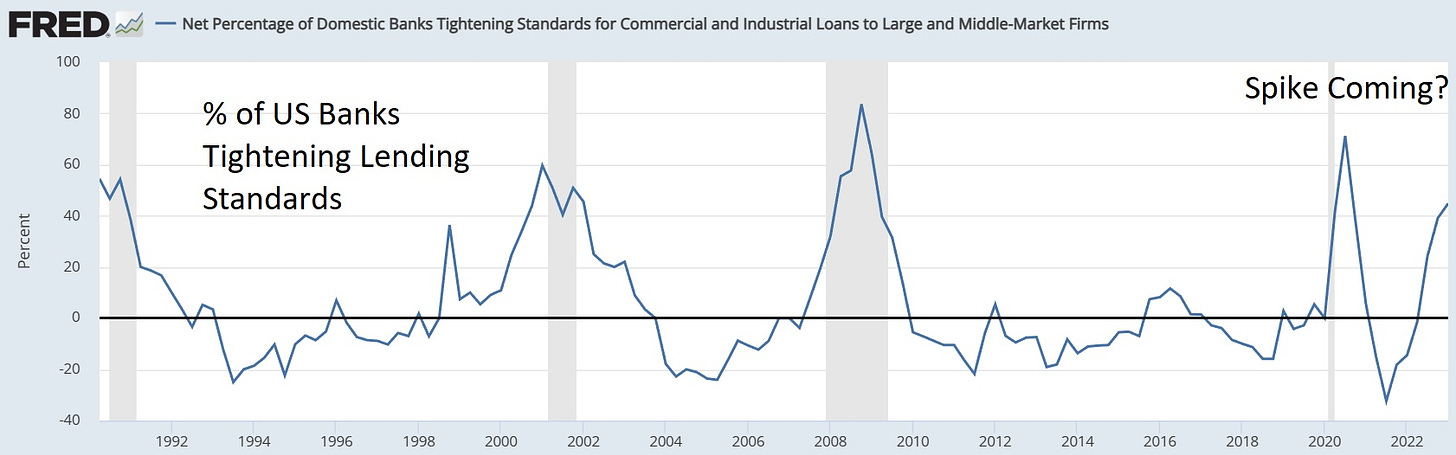

Lenders were already afraid. Now they are terrified

Banks were already tightening credit standards before last week’s flash crash. Now virtually everyone will stop lending to anyone but their strongest customers. A year from now, the updated version of this chart will show an increase to record high levels of tightening.

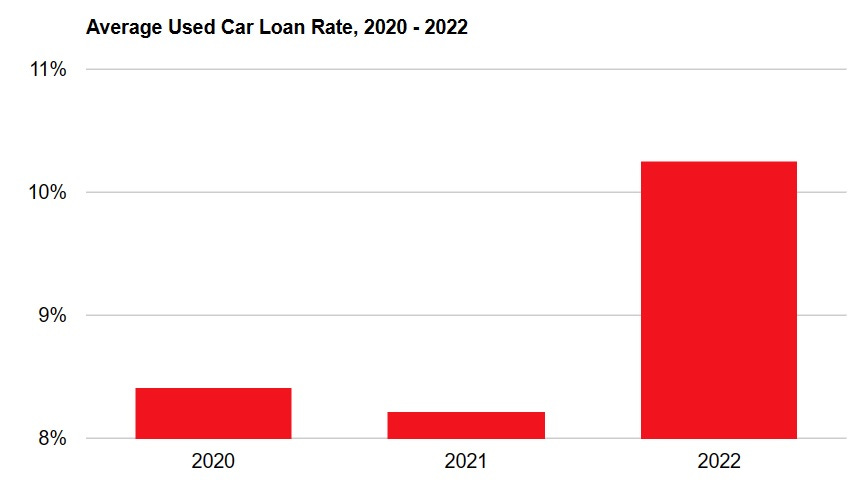

Automobiles are a bursting bubble

The number of underwater car loans, where the loan balance exceeds the value of the car, has been on the rise for months. Interest rates on used car loans had risen from an average of 8% to more than 10% last year. And auto loan delinquency rates have risen to their highest levels in more than 15 years, with a particularly large jump among subprime borrowers. Now panicked banks will make car loans even harder to get, while increasing numbers of borrowers will default on their existing loans. Typical recession behavior, but this time in a crisis context.

Commercial real estate was toast anyway, but now it’s burnt toast

Office, warehouse and other buildings never fully recovered from the pandemic lockdowns, and by the fourth quarter of 2022 defaults on commercial real estate loans were rising sharply. Building prices were beginning to fall and the specter of a commercial real estate crash was looming. And that was before banks and regulators went into their current panic mode. Now just try refinancing an underperforming office complex and see how it goes.

And there’s more…

Stephanie Pomboy, an analyst whose work has been spot on lately, tweeted this 12 hours ago:

you know what keeps me up at night Thinking about FINAL NONbank institutions’ invisible exposure to things much riskier than the things that bring banks down. Esp, the prospect that some insurer (& counterparty in the giant credit derivatives mkt) is about to rise.

And don’t even get me started on pensions. I’ve rambled on breathlessly about this. They will be subject to a rescue like we have never witnessed before. If you think the bank bailout is going to be massive… stay tuned. You haven’t seen anything.

In other words, a lot can still go wrong, because excessive leverage is lurking everywhere. A drop in pensions would mean, say, a multi-trillion dollar bailout, and that was probably coming even in “normal” times. As for derivatives, well, they’ll end up destroying the world, so why not now?

Takeaway food? In the midst of all the various credit crises, controlling inflation will take a back seat. And the world will realize that central banks are out of ammunition, with no choice but to let their currencies burn.

Read the full article at John Rubino.

John Rubino is a former Wall Street financial analyst and the author or co-author of five books, including The Money Bubble: What to Do Before It Bursts and Clean Money: Picking Winners in the Green-Tech Boom. He founded the popular financial website DollarCollapse.com in 2004 and sold it in 2022.

See also:

Understand the times we are currently living in

Year 2023: Will America Fulfill Its Destiny? Jesus Christ is the only “transhuman” the world has seen or will ever see

An invitation to technologists to join the winning side

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

Spiritual wisdom vs. natural knowledge: why there is so much deception today

How to determine if you are a disciple of Jesus Christ or not

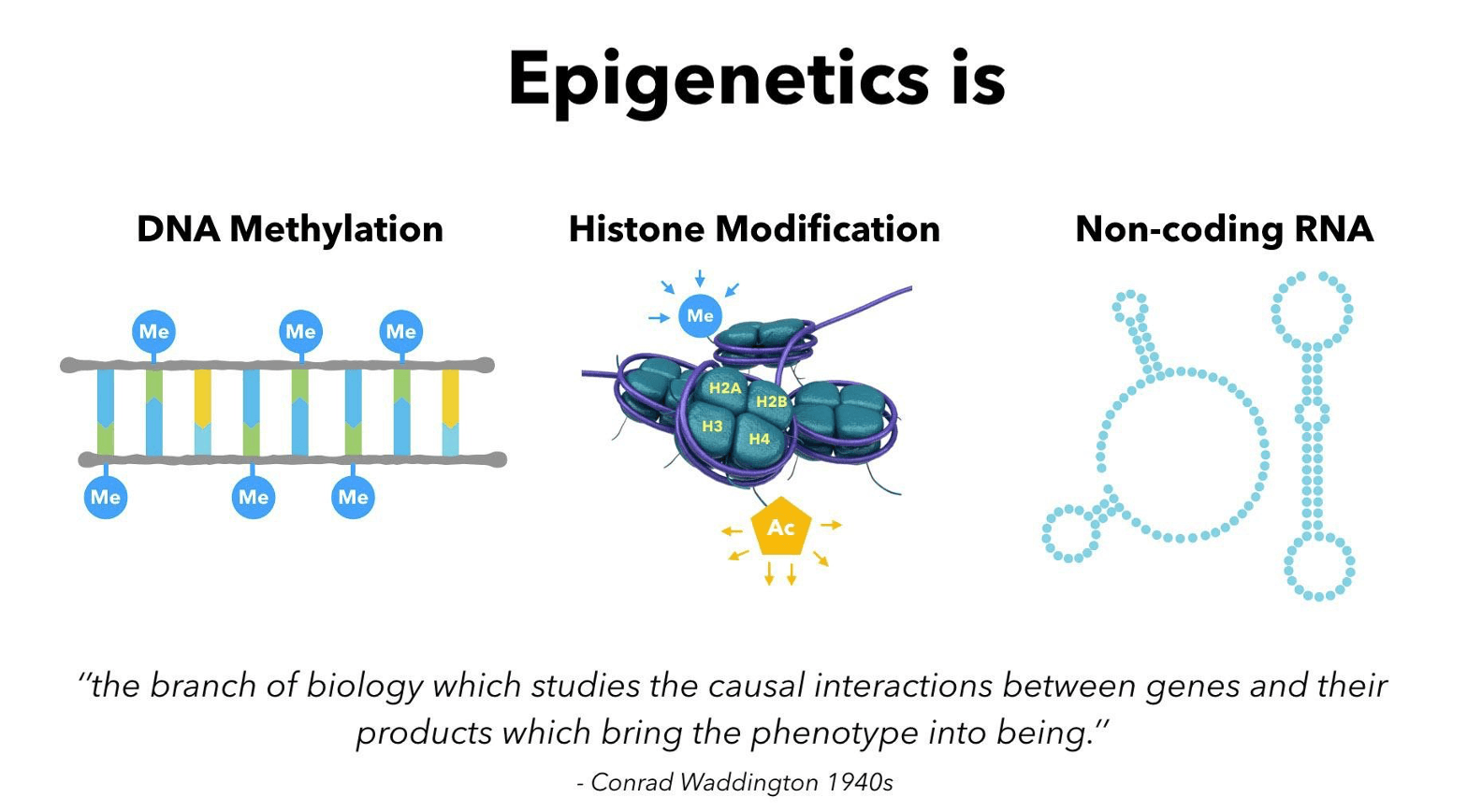

Epigenetics exposes Darwinian biology as religion: Your DNA does NOT determine your health!

What happens when a holy and just God gets angry? Lessons from history and the prophet Jeremiah

Insider exposes Freemasonry as the world’s oldest secret religion and Luciferian plans for the new world order

Identifying the Luciferian Globalists Implementing the New World Order: Who Are the “Jews”?

Posted on March 21, 2023