Written by Matthew Piepenburg via GoldSwitzerland.com,

Next, we look at the math, history and current environment of oil in the context of a global debt crisis to better predict the direction of the currency and gold markets without the need for tarot cards.

Seeing the Future: Math vs. Crystal Balls

Those looking ahead need only look at the current and backward math to make relatively clear forecasts without risk the cup game to derive crystal ball predictions.

Unsurprisingly, the subject matter and the math of simple (as well as horrendous) US debt levels make this vision of the future almost too simple.

The Oil Question: Is Anti-Shale Anti-American?

Although not as fluent as others in the oil trade or the green politics of the American far left, I have argued in previous reports that the current administration’s anti-shale policies make a good (debatable?) environmental splash while ignoring the math, history, and science of national and global thought.

(But then again, the whole woke fiasco of current US politics seems to be on a crusade to cancel things like math, history, and science; so thinking contextually or globally is beyond their discourses of bite-driven strains).

Oil, however, still matters.

And when understood in the broader context of the macroeconomic issues we’ve followed for years, namely debt, currencies, inflation, gold, a cornered Fed and a Armed USD–current and future trends are already in motion.

And as for the never-ending debate about global warming, butterfly-friendly energy policies, and the simple reality of fossil fuels as part of our planet, rather than a threat, I’m not here to answer or resolve the same.

The Germans (and their solar power ideas in a part of Europe with very little sun) certainly don’t get it… In fact they get a lot of their (nuclear) power from France and now they are forced to burn coal to get through the winter.

I am here, however, to lay out some objective facts and ask some hard-hitting questions.

Oil policy

Biden, it seems pretty clear to everyone, is not in charge of US politics.

This is a scary fact. Even scarier, though, is determining who’s in charge?

Again, I can’t answer.

But if he were in charge, we’d all be amused to wonder how he expected Saudi Arabia to receive him and his embarrassing pleas to increase Saudi production (ostensibly to ease inflated US fuel costs) after previously saying to the world that considered Saudi Arabia a pariah state…

We all remember that embarrassing fist fight with the Crown Prince.

Meanwhile, Saudi Arabia spends much more time with the Chinese and Iran…

We’d also like to hear the White House explain how it hopes increased US shale production will reduce energy inflation when it has simultaneously been trying to legislate oil off the American page.

Also, it would be worth reminding Americans and politicians weary of inflated fuel prices that the vast majority of these inflated costs at the pump are due to US per-gallon taxes, not Saudi production cuts.

But I digress.

Oil math

At current levels of US oil production and exploration, the US (according to its own Dallas Fed) will have to engage in annual levels of energy price inflation of 8-10% just to keep the lights on. the oil industry fires at an equilibrium price level.

These conservative inflation figures for oil/fuel prices, when considered in the context of over $31 billion in US federal debt, basically mean that Uncle Sam’s ability to cover his burden of ever-increasing public debt will weaken at least by 8 to 10% per year. at a time in American history where Uncle Sam needs all the help, rather than weakness, he can get.

Fight inflation with inflation and debt with debt?

It goes without saying that the only “solution” to these inflated debt burdens will be the monetary mouse click in the Eccles Building, whose (still ossified) “solution” to dealing with inflated oil prices is policy even more inflationary to print more fake money to “falsely” cure an inflationary crisis.

You can’t really make this stuff up.

The monetary policy of the Fed, since then patient-zero Greenspan sold his soul (and hard money gold backed academic thesis) to Wall Street and Washington, it comes down to this: We can solve a debt crisis with more debt and an inflation crisis with more, well… inflation .

Does this sound like “sound monetary policy” to you?

Or do you just export your inflation to the rest of the world?

But as I’ve warned for years, Uncle Sam’s first instinct (as holder of the world’s reserve currency) whenever he’s handed a self-inflicted inflationary hot potato is to hand it to the rest of the world, in other words that is, export their inflation to friends and foes alike.

Global energy importers in Europe, emerging markets, India, China and Japan, for example, are facing what accountants call a balance of payments crisis, but what I’ll bluntly call by its real name : a currency crisis.

That is, under the current, but potentially dying, petrodollar system, these countries will need more dollars to buy oil.

But here lies the problem.

Because?

Simple: those USD are drying up (unless more are printed).

How long will global currencies (and leaders) remain prisoners of the USD?

Regardless of whether you believe in the perpetual hegemony of the USD as a payment system or not, we can all agree that the liquidity of the USD is drying up (whether due to the absorption of the milkshake theory in euro-dollar and derivatives markets or from post-sanction dedollarization).

Nations facing the double whammy of needing more dollars to pay for inflated oil prices and inflated dollar-denominated debts around the world are crying “uncle!” rather than just “Uncle Sam”.

What can these nations do in the face of this bullying hot potato known as the USD? How can they cope with these increased payment burdens (oil and debt) in USD?

How the US creates a global currency crisis

Well, short of turning their backs on the USD (not yet), the only current option other nations have is to devalue (ie inflate and debase) their own currencies at home, which is like Uncle Sam it makes his problem almost everyone else’s. problem…

As I often say, with friends like the US, who needs enemies?

Something, however, has to give.

As physical gold offers better prices than fiat dollars

This clearly broken system of the US exporting its inflation to a world forced since the 1970s to import oil with a broken and inflationary Greenback has real implosion potential.

Already, countries like Ghana have realized that it is better to trade oil with real gold instead of fake fiat dollars.

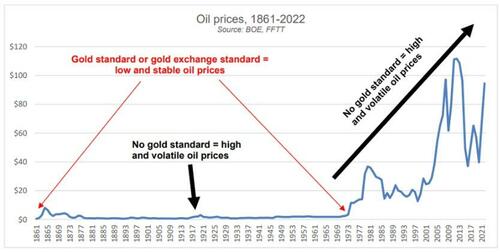

Long before the petrodollar became the mad king, for example, history recognized that physical gold was a much better means of payment for establishing a stable oil price.

Check it out yourself.

As more and more of the world recognizes that the currency crisis is slowly at play, and tomorrow more and more painful, this “balance of payments” (i.e. currency) crisis can easily evolve into a reality. of “exchange of payments” in which gold re-emerges as a superior payment system for oil.

Think about this.

More tailwinds for gold

At the time of writing, physical oil markets are more than 15 times the size of physical gold markets on an annualized (USD) production basis.

If the world turns slowly (then all at once?) towards liquidating oil in gold (partially or fully) to avoid a global monetary crisis, gold will have to be revalued to levels significantly higher than current prices.

Hmmm.

Something worth following, right?

Well, the Zeitgeist suggests we’re not the only ones following these trends…

Central banks are grabbing (and hoarding) gold

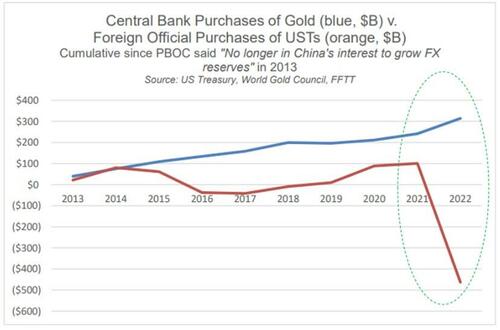

A recent poll of more than 80 central banks with more than $7 billion in foreign exchange reserves indicated that 2 in 3 respondents strongly believe that central banks will make more, not less, purchases of physical gold in 2023.

Again: Are you seeing a trend? Are you seeing the context? Are you seeing why?

As I have said countless times and will say many more times: debt is important.

Debt is important because debt, once it crosses the Rubicon of insanity and unsustainability, affects everything we market jocks are supposed to have been taught in school and at the office, ie bonds, currencies, inflation and recessionary cycles. debt cycles.

In short: everything is connected.

Once you understand debt, the policies, reactions, weaknesses, truths, lies and cycles are much easier to see rather than simply “predict”.

The growing loss of faith in the world’s reserve currency and its shameful IOUs (i.e. USTs) is not just the domain of the “gold bugs”, but the simple and historical consequence of the hard math that always follows the broken regimes, of which the US is. and it will not be an exception.

So the chart below is worth repeating as the world is clearly drifting apart Uncle Sam’s Drunk Bar Tabfrom degraded dollars and IOUs to something more finite in supply but more infinite in duration.

Again: Do you see the trend?