Source of the image.

for Mark Hulbert

Market surveillance

Excerpts:

There is a very real possibility that the government will stop issuing Social Security payments after reaching the debt limit.

However, as scary as that prospect is, the alternative could be even worse: A little-known provision of a 1996 law could be interpreted to allow the Social Security trust fund to be used for more than just paying monthly checks of Social Security, but also to avoid the debt and payment limit all otherwise overdue government bills.

If that happens, any short-term relief for Social Security recipients would come at a potentially huge long-term price: The Social Security trust fund could be depleted far sooner than currently anticipated, in fact in just a couple of days. ‘years.

These dire possibilities emerge from an analysis by Steve Robinson, the chief economist of The Concord Coalition, a group that describes itself as “a nonpartisan organization dedicated to educating the public and finding common sense solutions to policy challenges prosecutor of our nation.”

A summary of the issue he wrote, titled “Social Security Debt Limit Escape Clause,” is available on the group’s website.

Let me hasten to add that Robinson is not advocating that the Social Security trust fund be used in this way. In an interview, however, he emphasized that he wrote his summary because we must be aware not only that this “escape clause” exists, but that its use could have unintended consequences. While almost no one outside Washington knows it even exists, and relatively few on Capitol Hill, the Treasury Department and the Social Security Administration are well aware of it.

The 1996 law creating the escape clause was passed after the government reached its debt ceiling in 1995 and 1996. Ironically, the intent of this law was to prevent that the Social Security trust fund is used for anything other than the payment of Social Security benefits. But, Robinson explains, this is unfeasible in the real world. This is because Social Security checks are sent by the General Treasury account, and if that account is in default, the checks would bounce.

Therefore, if and when the debt limit is reached, the only way, in practice, to continue issuing and clearing Social Security checks through the banking system would be for the Social Security trust fund to “lend ” to the Treasury sufficient funds so that it could pay all unfulfilled obligations of the government.

So if the debt ceiling is reached, which is expected to happen perhaps as early as June, Congress and the president will be faced with a major dilemma:

Do they allow Social Security checks to continue cashing, risking the political fallout of being accused of “attacking” the Social Security trust fund? Or do they stop issuing Social Security payments, risking the political consequences of not issuing Social Security payments, on which many seniors currently depend for their livelihoods?

You can appreciate why Congress and the President don’t want them to know that this Safeguard Clause exists. Once we are aware of it, they put themselves in a no-win situation.

Read the full article at Market surveillance.

See also:

Understand the times we are currently living in

Year 2023: Will America Fulfill Its Destiny? Jesus Christ is the only “transhuman” the world has seen or will ever see

An invitation to technologists to join the winning side

Synagogue of Satan: Why It’s Time to Leave the Corporate Christian Church

Spiritual wisdom vs. natural knowledge: why there is so much deception today

How to determine if you are a disciple of Jesus Christ or not

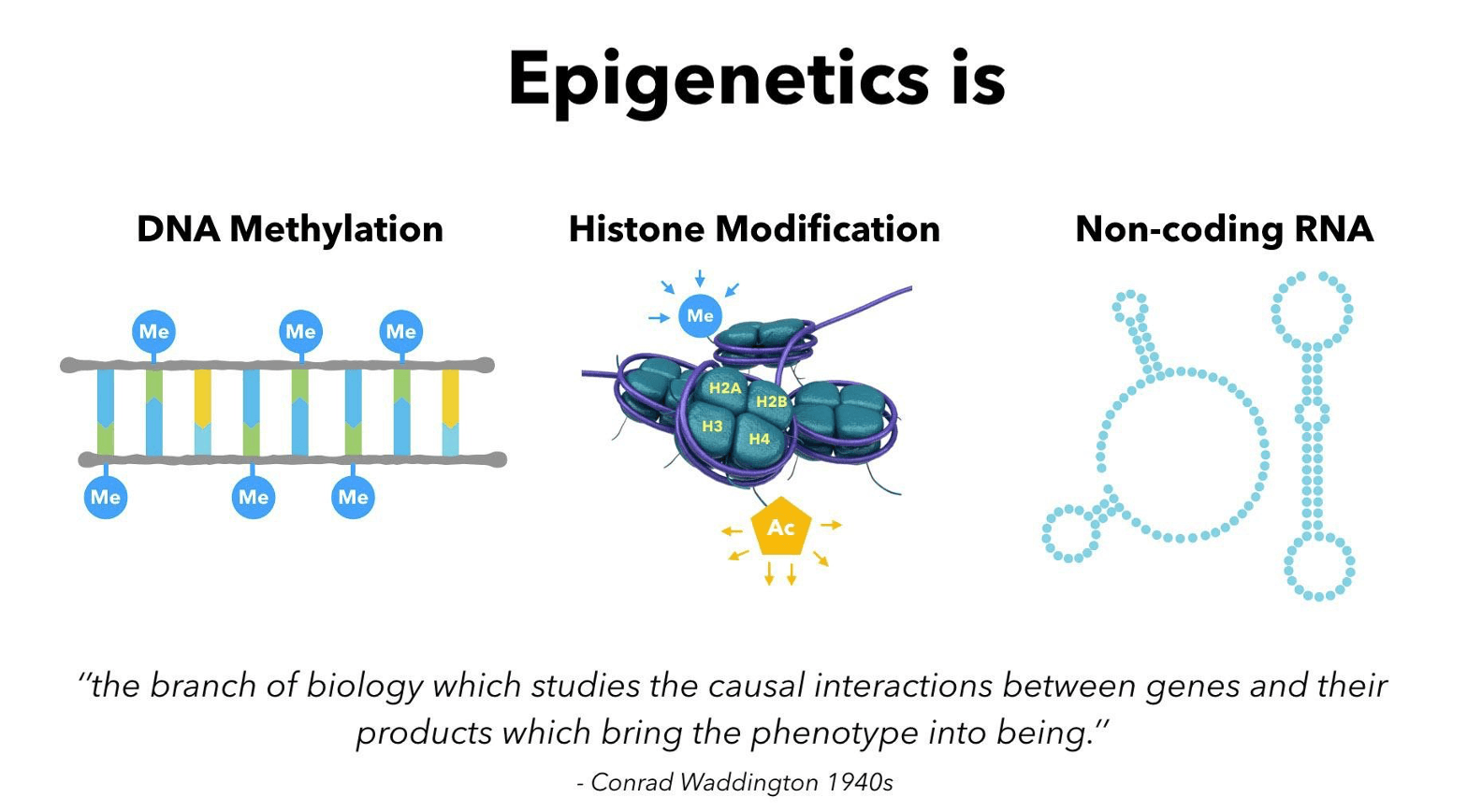

Epigenetics exposes Darwinian biology as religion: Your DNA does NOT determine your health!

What happens when a holy and just God gets angry? Lessons from history and the prophet Jeremiah

Insider exposes Freemasonry as the world’s oldest secret religion and Luciferian plans for the new world order

Identifying the Luciferian Globalists Implementing the New World Order: Who Are the “Jews”?

Posted on March 10, 2023